📊 Lifestyle Match

Visualizing the tradeoffs between Antioch and Houston

Detailed breakdown of cost of living, income potential, and lifestyle metrics.

Visualizing the tradeoffs between Antioch and Houston

Line-by-line data comparison.

| Category / Metric | Antioch | Houston |

|---|---|---|

| Financial Overview | ||

| Median Income | $91,256 | $62,637 |

| Unemployment Rate | 5.5% | 4.8% |

| Housing Market | ||

| Median Home Price | $602,750 | $335,000 |

| Price per SqFt | $306 | $175 |

| Monthly Rent (1BR) | $2,304 | $1,135 |

| Housing Cost Index | 200.2 | 106.5 |

| Cost of Living | ||

| Groceries Index | 117.2 | 103.4 |

| Gas Price (Gallon) | $3.98 | $2.35 |

| Safety & Lifestyle | ||

| Violent Crime (per 100k) | 567.0 | 912.4 |

| Bachelor's Degree+ | 27.2% | 37.1% |

| Air Quality (AQI) | 60 | 44 |

AI-generated analysis based on current data.

Welcome to the ultimate showdown. You’re standing at a crossroads, and the map is pointing to two wildly different destinations: Houston, Texas and Antioch, California. One is a sprawling, energy-driven behemoth in the heart of the South. The other is a suburban gateway nestled in the East Bay, shadowed by San Francisco’s influence.

This isn’t just about geography; it’s about lifestyle, wallet weight, and what you’re willing to trade off. As your relocation expert, I’ve crunched the numbers, felt the cultural vibes, and I’m here to give you the real, unfiltered advice. Grab your coffee, and let’s dive into the data.

Houston is a city that defies categorization. It’s not a city of skyscrapers and sidewalks; it’s a city of freeways and neighborhoods. The vibe is gritty, diverse, and unpretentious. It’s the energy capital of the world, with a booming job market that attracts dreamers and hustlers. The culture is a melting pot—world-class museums, a legendary food scene (you haven’t lived until you’ve had Viet-Cajun crawfish), and a laid-back, "y'all come" attitude. It’s for the ambitious professional, the foodie, and the family seeking space and opportunity without breaking the bank.

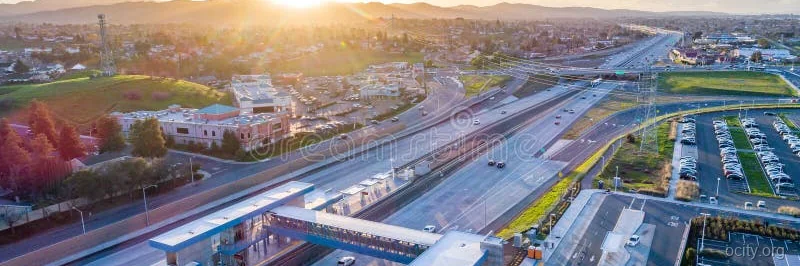

Antioch is a different beast. It’s a classic California suburb with a complex identity. It sits on the edge of the Bay Area, offering proximity to San Francisco’s tech money and culture while maintaining a more affordable (for California) entry point. The vibe is family-oriented, diverse, and steadily gentrifying. It’s for those who want the California dream—proximity to beaches, wine country, and tech jobs—without the sticker shock of Silicon Valley or San Francisco proper. It’s for the young family priced out of Oakland, the commuter willing to ride BART for an hour, and the retiree seeking a milder climate.

Verdict:

This is where the rubber meets the road. Let's talk purchasing power. Where does your paycheck actually feel bigger?

The biggest factor? Taxes. Texas has 0% state income tax. California has one of the highest state income tax rates in the nation, topping out at 13.3% for high earners. This single fact changes everything.

Let’s break it down with a head-to-head data table. We'll use the provided data and contextualize it.

| Category | Houston, TX | Antioch, CA | Winner & Analysis |

|---|---|---|---|

| Median Home Price | $335,000 | $602,750 | Houston. This is a staggering 80%+ difference. In Houston, you get significantly more home for your money. |

| Rent (1BR) | $1,135 | $2,304 | Houston. Rent is less than half of Antioch's. The "California premium" is in full effect. |

| Housing Index | 106.5 | 200.2 | Houston. A score of 100 is the national average. Houston is 6.5% above average. Antioch is over 100% more expensive than the national average. |

| Median Income | $62,637 | $91,256 | Antioch. On paper, incomes are higher in California. But... |

| Purchasing Power | Massive Advantage | Significant Disadvantage | Houston. Let's run the scenario: A household earning $100k. In Houston, with no state income tax, your take-home is higher. Your housing costs (rent/mortgage) are dramatically lower. In Antioch, that same $100k is stretched thin by high housing costs and state taxes. In Houston, $100k feels like $130k+ in Antioch. |

The Insight: Don't be fooled by Antioch's higher median income. The cost of living differential is so extreme that it erases the income advantage. Houston offers bang for your buck at a level Antioch can't match. If you're moving from a high-tax state to Texas, you'll feel the financial relief almost immediately.

Houston: A Buyer's Playground (With Caveats)

Houston's market is vast and varied. For $335,000, you can find a nice 3-bedroom home in a decent suburb like Katy or Cypress. The market is competitive but not cutthroat. Inventory is generally better than in coastal cities. The big caveat? Insurance. With hurricane risks, home insurance can be a significant and rising cost. Renting is incredibly affordable, making it a great city to land in while you scout neighborhoods.

Antioch: A Seller's Market (Even for Renters)

Antioch's market reflects the brutal Bay Area reality. At over $600k for a median home, you're looking at smaller properties, often older, and fierce competition. Renting isn't a cheap escape—$2,304 for a 1BR is the norm. The market is tight, driven by commuters who want a slice of California without the San Francisco price tag. It's a seller's and landlord's market.

Verdict: For accessibility and volume of options, Houston is the clear winner. Antioch's market is for those with deep pockets or a very specific commitment to the Bay Area lifestyle.

Winner: Antioch (if you value public transit over a car-dependent life).

Winner: Antioch. Unless you love tropical humidity, Antioch's climate is a bigger draw.

This is a sensitive but crucial category. Let's be direct with the data.

Verdict: By the numbers, Antioch has a lower violent crime rate. However, both cities require vigilance and neighborhood-specific research. Safety is hyper-local.

This isn't about one city being "better" than the other. It's about which city is better for you.

🏆 Winner for Families: HOUSTON

Why? The math is undeniable. For the price of a median home in Antioch ($602,750), you can buy a much larger home in a top-rated Houston suburb like The Woodlands or Sugar Land. The 0% state income tax means more money for college funds, vacations, and savings. While you'll deal with heat and traffic, the financial breathing room and space for kids to grow are unparalleled.

🏆 Winner for Singles/Young Professionals: ANTIOCH

Why? Proximity to San Francisco and the Bay Area's tech ecosystem is a career accelerant that Houston can't match. The social scene is tied to the entire Bay Area. The ability to commute via BART, while long, offers a different lifestyle than car-dependent Houston. For a young professional whose career is tied to tech, media, or finance, Antioch's location is a strategic play, even with the high cost.

🏆 Winner for Retirees: HOUSTON

Why? This might surprise you. While Antioch has a milder climate, the financial strain on a fixed income is severe. Houston's lower cost of living, especially for housing, means retirement savings go much further. The healthcare system is robust (Texas Medical Center is the largest in the world). The trade-off is the heat, but many retirees find the indoor, air-conditioned lifestyle manageable. For retirees not tied to a Bay Area career, Houston offers financial peace of mind.

Pros:

Cons:

Pros:

Cons:

Final Thought: Houston is a city of opportunity and space, where your dollar is king. Antioch is a city of access and climate, where you pay a premium for the California address. Your choice hinges on a simple question: Are you optimizing for financial freedom or career proximity? Choose wisely.