📊 Lifestyle Match

Visualizing the tradeoffs between Antioch and Philadelphia

Detailed breakdown of cost of living, income potential, and lifestyle metrics.

Visualizing the tradeoffs between Antioch and Philadelphia

Line-by-line data comparison.

| Category / Metric | Antioch | Philadelphia |

|---|---|---|

| Financial Overview | ||

| Median Income | $91,256 | $60,302 |

| Unemployment Rate | 5.5% | 4.7% |

| Housing Market | ||

| Median Home Price | $602,750 | $270,375 |

| Price per SqFt | $306 | $204 |

| Monthly Rent (1BR) | $2,304 | $1,451 |

| Housing Cost Index | 200.2 | 117.8 |

| Cost of Living | ||

| Groceries Index | 117.2 | 100.3 |

| Gas Price (Gallon) | $3.98 | $3.40 |

| Safety & Lifestyle | ||

| Violent Crime (per 100k) | 567.0 | 726.5 |

| Bachelor's Degree+ | 27.2% | 35.7% |

| Air Quality (AQI) | 60 | 40 |

AI-generated analysis based on current data.

Alright, let's cut through the noise. You're trying to decide between Philadelphia, PA, and Antioch, CA. This isn't just a geography lesson; it's a life-altering choice between two drastically different worlds. One is a gritty, historic East Coast powerhouse. The other is a sun-soaked, commuter hub in the Bay Area's shadow.

I’ve crunched the numbers, felt the vibes, and compared the data. Let's get into it.

Philadelphia is the underdog with a chip on its shoulder. It’s the "City of Brotherly Love" that’s anything but soft. Think world-class museums, iconic cheesesteaks, and a sports fanbase that will love you unconditionally (or yell at you for wearing the wrong jersey). It’s a major metro area with a population of 1.5 million, offering the energy of a big city without the soul-crushing price tag of New York or D.C. It’s for the history buff, the foodie on a budget, and the professional who wants substance over status symbols.

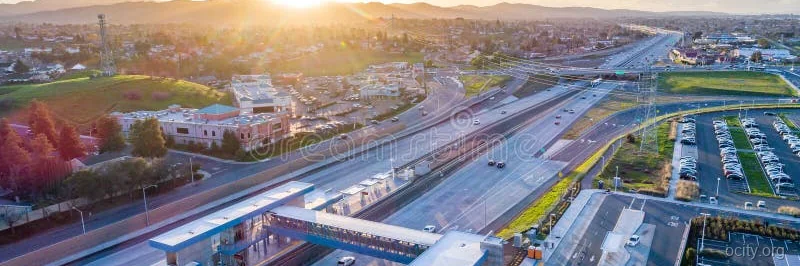

Antioch is the quintessential California dream—for the price of admission. It’s a city of 117,000 tucked into the East Bay, offering a more suburban, family-friendly vibe with a laid-back atmosphere. The weather is a major draw (though the data is missing, we know it’s Mediterranean), and you’re within a 45-minute drive to San Francisco and an hour to Napa Valley. It’s for the commuter who prioritizes sunshine and space, willing to trade a shorter commute for a bigger mortgage.

Who’s it for?

This is where the rubber meets the road. Let's talk purchasing power.

Salary Wars: If you earn $100,000 in Philadelphia, you’re living quite well. The median income is $60,302, so you’re in the top tier. Your money stretches. In Antioch, that same $100k is closer to the median ($91,256), but it will feel like half what it does in Philly. The Bay Area is a different universe of costs.

Taxes: Pennsylvania has a flat state income tax of 3.07%. California’s is progressive, maxing out at 13.3% for high earners. On a $100k salary, you’d pay roughly $3,070 in PA state tax, versus about $6,500+ in CA (depending on deductions). That’s a $3,430 difference—immediately erasing any "salary bump" you might get for moving to CA.

Table: Monthly Cost of Living (Approx.)

| Category | Philadelphia | Antioch | The Takeaway |

|---|---|---|---|

| Rent (1BR) | $1,451 | $2,304 | Antioch is 59% more expensive. You pay a significant premium for CA sun. |

| Utilities | ~$150 | ~$200 | CA energy is pricier, especially with AC needs. |

| Groceries | ~$400 | ~$500 | CA has a higher baseline for food costs. |

| Housing Index | 117.8 | 200.2 | Antioch is 70% more expensive for housing than the national average. Philly is still above average, but far more manageable. |

Verdict on Dollar Power: Philadelphia wins by a landslide. The $853/month lower rent alone is a game-changer. Add in lower taxes and you’re looking at over $10,000 in annual savings just on housing and state taxes. In Antioch, you’re paying for the privilege of being in the Bay Area ecosystem.

Philadelphia: The market is competitive but not impossible. A median home price of $270,375 is a dream compared to most major metros. You can actually find a rowhouse or a decent condo for that price. It’s a buyer’s market in many neighborhoods, with more inventory than you’d expect. Renting is also a viable long-term strategy given the relative affordability.

Antioch: This is a different beast. A median home price of $602,750 requires a massive down payment and a hefty mortgage. The Housing Index (200.2) screams "sticker shock." It’s a seller’s market, with high demand from Bay Area commuters looking for "affordable" alternatives. Rent is equally punishing. Buying here is a major financial commitment, often requiring dual high incomes.

Verdict: If you want to build equity without becoming house-poor, Philadelphia is the clear choice. Antioch’s market is for those already entrenched in the California economy.

Winner: Philadelphia. The ability to live and work without being glued to a steering wheel is a massive quality-of-life boost.

Winner: Antioch. If weather is your top priority, no contest. You trade seasons for consistency.

Winner: Antioch, by a hair. Both cities have crime, but Antioch’s rate is marginally lower. Neither is a "safe haven" without careful neighborhood selection.

After digging into the data and the lifestyle, here’s the final breakdown.

🏆 Winner for Families: Philadelphia

🏆 Winner for Singles/Young Pros: Philadelphia

🏆 Winner for Retirees: Philadelphia

Philadelphia

Antioch

Bottom Line: If you value affordability, culture, and walkability, choose Philadelphia. If you prioritize weather, proximity to tech jobs, and suburban space above all else—and can afford the premium—choose Antioch.

For most people, Philadelphia offers a far more balanced and financially sustainable quality of life. Antioch is a specific choice for those already in the Bay Area ecosystem.