📊 Lifestyle Match

Visualizing the tradeoffs between Evansville and Phoenix

Detailed breakdown of cost of living, income potential, and lifestyle metrics.

Visualizing the tradeoffs between Evansville and Phoenix

Line-by-line data comparison.

| Category / Metric | Evansville | Phoenix |

|---|---|---|

| Financial Overview | ||

| Median Income | $52,318 | $79,664 |

| Unemployment Rate | 3.7% | 4.1% |

| Housing Market | ||

| Median Home Price | $150,750 | $457,000 |

| Price per SqFt | $114 | $278 |

| Monthly Rent (1BR) | $850 | $1,599 |

| Housing Cost Index | 60.2 | 124.3 |

| Cost of Living | ||

| Groceries Index | 94.1 | 98.4 |

| Gas Price (Gallon) | $3.40 | $3.40 |

| Safety & Lifestyle | ||

| Violent Crime (per 100k) | 456.0 | 691.8 |

| Bachelor's Degree+ | 24% | 33.5% |

| Air Quality (AQI) | 31 | 39 |

AI-generated analysis based on current data.

Choosing a place to live isn't just about numbers on a spreadsheet. It's about the rhythm of your life, the weight of your wallet, and the weather that will greet you every morning. You've got two wildly different contenders on the table: the sprawling, sun-drenched metropolis of Phoenix, Arizona (population: 1.65 million) versus the compact, river-valley charm of Evansville, Indiana (population: 113,291).

This isn't a battle of equals; it's a clash of lifestyles. One is a fast-paced, desert giant. The other is a slow-burn, affordable heartland hub. Let's cut through the noise, crunch the data, and figure out which one is your next home.

Phoenix is a city that defies geography. It's a concrete oasis in the Sonoran Desert, a place where modern skyscrapers glitter against mountain backdrops and sprawling suburbs stretch for miles. The vibe is ambitious, sun-baked, and relentlessly growing. It’s for the go-getter who loves the outdoors (when it's not 115°F), craves a big-city feel with suburban comfort, and doesn’t mind the hustle. It’s a transplant city—full of people who came here for jobs, sunshine, and a fresh start.

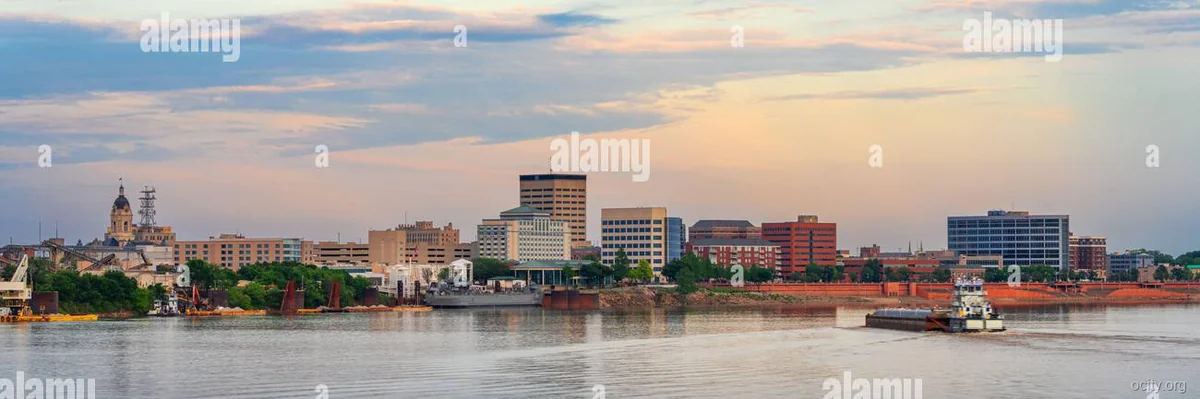

Evansville is the quintessential Midwestern gem. Nestled on a bend of the Ohio River, it’s a city with a deep sense of place and history. The vibe is laid-back, community-focused, and unpretentious. Life moves at a human pace here. It’s for the person who values knowing their neighbors, wants to own a home without breaking the bank, and prefers four distinct seasons over eternal sunshine. It’s a city of roots, where generations often stay.

Who is it for?

This is where the showdown gets real. The cost of living is the single biggest factor for most movers. Let's break down the cold, hard cash.

| Category | Phoenix, AZ | Evansville, IN | Winner |

|---|---|---|---|

| Median Home Price | $457,000 | $150,750 | Evansville 🏆 |

| Rent (1BR) | $1,599 | $850 | Evansville 🏆 |

| Housing Index | 124.3 (24.3% above nat'l avg) | 60.2 (39.8% below nat'l avg) | Evansville 🏆 |

| Median Income | $79,664 | $52,318 | Phoenix 🏆 |

The Salary Wars: Purchasing Power Explained

At first glance, Phoenix's $79,664 median income looks far more impressive than Evansville's $52,318. But income is only half the story. The real question is purchasing power—what that paycheck can actually buy.

Let's say you earn $100,000 in both cities. In Evansville, you are in the top tier of earners, living like royalty. Your $850 rent is a fraction of your income, and a $150,750 home is not just attainable—it's a steal. You can save aggressively, travel, and live comfortably, with plenty of cash left over.

In Phoenix, earning $100,000 puts you solidly in the middle class. But you'll immediately feel the sticker shock. Your $1,599 rent is double Evansville's. A median home at $457,000 eats up a massive chunk of your income. Your purchasing power is significantly diluted. The difference isn't just in the numbers; it's in the lifestyle. In Phoenix, you might be house-poor. In Evansville, you could be mortgage-free in a decade.

Tax Insight: This is a crucial tie-breaker. Indiana has a flat income tax of 3.23%. It's straightforward and predictable. Arizona has a progressive income tax, with rates ranging from 2.5% to 4.5% (as of 2024). While the top bracket is higher, the overall tax burden can be more complex. For high earners, Arizona's taxes might be a bigger bite, further eroding that salary advantage.

Verdict:

🏆 WINNER: Evansville.

The financial gap is staggering. Evansville offers a level of affordability that Phoenix simply can't match. The "bang for your buck" in Evansville is off the charts. If your primary goal is financial freedom and comfort, Evansville isn't just the winner—it's not even a contest.

Phoenix: The Seller's Market & The Heat Premium

Phoenix's housing market is a pressure cooker. With a Housing Index of 124.3, it's 24% more expensive than the national average. The median home price of $457,000 is a reality check for many. This is a strong seller's market. Competition is fierce, bidding wars are common, and inventory is tight. You're not just paying for square footage; you're paying for the "Arizona tax"—the premium for sunshine, a booming job market, and a desirable (if brutal) climate. Renting is also a competitive game, with $1,599 for a one-bedroom being the entry point.

Evansville: The Buyer's Paradise

With a Housing Index of 60.2, Evansville is nearly 40% cheaper than the national average. The median home price of $150,750 feels like a typo to anyone from a coastal or major metro area. This is a buyer's market. Inventory is generally good, and sellers have less leverage. You can find a charming, historic home for the price of a down payment in Phoenix. Renting is a walk in the park; $850 for a one-bedroom is not only affordable but leaves room in your budget for savings and fun.

Verdict:

🏆 WINNER: Evansville.

For anyone looking to buy a home without taking on a crushing mortgage, Evansville is the clear champion. The market is accessible, stable, and offers incredible value. Phoenix's market is for those with high incomes or who are willing to stretch their budget significantly for the location.

This is where personal preference overrides data. Let's talk about the daily grind.

Verdict: 🏆 Evansville. The time you save not sitting in traffic is priceless.

Verdict: 🏆 It's a Tie (Subjective).

This is pure personal taste. Do you hate cold and snow more than you hate extreme, life-threatening heat? There's no objective winner here. It’s your #1 dealbreaker.

Verdict: 🏆 Evansville.

The data points to Evansville as the safer option. However, safety is hyper-local. Always research specific neighborhoods in either city.

After weighing the data, the lifestyle, and the wallets, here’s the final breakdown.

The math is undeniable. The ability to secure a spacious home for $150,750 with a mortgage that's easily manageable on a median income is life-changing for a family. Add in lower crime, minimal traffic, and a strong community feel, and Evansville offers a stable, financially secure foundation that's hard to find anywhere else.

If your career is in tech, healthcare, or a major industry, Phoenix's diversified economy offers far more high-paying opportunities. The social scene is larger, more diverse, and offers endless networking and entertainment options. The "starter" life in Phoenix is about access to opportunity and a vibrant, if expensive, urban experience.

For those on a fixed income, Evansville is a dream. Stretching a retirement portfolio is infinitely easier when your housing costs are a fraction of what they'd be in Phoenix. The slower pace, four-season beauty (if you can handle the cold), and low stress are perfect for the golden years. Phoenix's retirees often have high savings to combat the heat and high costs.

Pros:

Cons:

Pros:

Cons:

This showdown has a clear financial and lifestyle winner for most, but your personal priorities will make the final call.

Choose Evansville if: Your top priorities are financial freedom, homeownership, safety, and a peaceful, community-oriented life. You are willing to trade big-city amenities for a dramatically lower cost of living and a slower pace.

Choose Phoenix if: Your top priorities are career growth, endless sunshine (for 8 months), a vibrant social scene, and access to a major metro's amenities. You have the income to manage its high costs and the resilience to endure its extreme heat.

Your life, your budget, your weather tolerance. Now you have the data to decide.