📊 Lifestyle Match

Visualizing the tradeoffs between Fort Myers and Philadelphia

Detailed breakdown of cost of living, income potential, and lifestyle metrics.

Visualizing the tradeoffs between Fort Myers and Philadelphia

Line-by-line data comparison.

| Category / Metric | Fort Myers | Philadelphia |

|---|---|---|

| Financial Overview | ||

| Median Income | $61,894 | $60,302 |

| Unemployment Rate | 4.2% | 4.7% |

| Housing Market | ||

| Median Home Price | $385,000 | $270,375 |

| Price per SqFt | $217 | $204 |

| Monthly Rent (1BR) | $1,331 | $1,451 |

| Housing Cost Index | 126.7 | 117.8 |

| Cost of Living | ||

| Groceries Index | 95.6 | 100.3 |

| Gas Price (Gallon) | $2.60 | $3.40 |

| Safety & Lifestyle | ||

| Violent Crime (per 100k) | 567.0 | 726.5 |

| Bachelor's Degree+ | 34.9% | 35.7% |

| Air Quality (AQI) | 40 | 40 |

AI-generated analysis based on current data.

Here is the ultimate head-to-head showdown between Philadelphia and Fort Myers.

So, you're standing at a crossroads. On one side, you have Philadelphia—the gritty, historic, no-frills East Coast powerhouse. On the other, you have Fort Myers—the sunny, laid-back Gulf Coast retreat that’s booming with retirees and transplants.

Choosing between them isn't just about picking a city; it's about choosing a lifestyle. Are you looking for the hustle and bustle of a major metro, or the slow, salty rhythm of coastal living? Let's cut through the noise and see where your next chapter should begin.

Philadelphia is a city with an attitude. It's the underdog that punches way above its weight class. This is a walkable, dense metropolis defined by distinct neighborhoods, world-class museums, and a food scene that goes way beyond the cheesesteak. It’s fast-paced, unpretentious, and deeply rooted in American history. You don't move to Philly for the weather; you move there for the culture, the energy, and the sheer variety of experiences. It’s a city for people who want to feel connected to something bigger, who thrive on urban buzz, and who don’t mind a little gray sky in exchange for endless entertainment options.

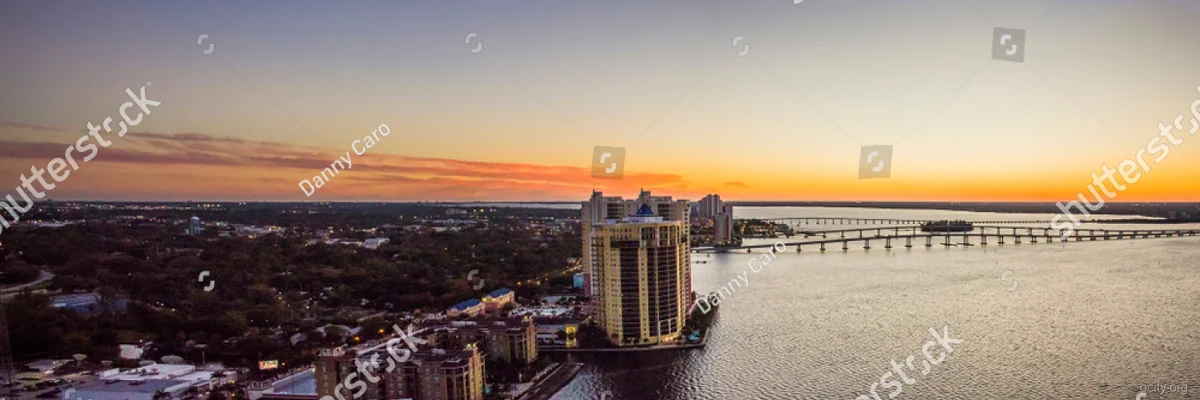

Fort Myers, by contrast, is all about the outdoors and the "good life." It’s a coastal city that feels more like a large town, anchored by a historic downtown but defined by its proximity to pristine beaches and nature preserves. The vibe here is decidedly slower. It’s about boating, fishing, golfing, and enjoying year-round outdoor living. While it’s seeing rapid growth, especially among young professionals and remote workers, it still carries a strong retirement community feel. You move to Fort Myers to escape the grind, prioritize your hobbies, and soak up the sun. It’s for the person who wants their backyard to be a playground.

Verdict: If you crave urban energy and cultural depth, Philadelphia wins. If you want a relaxed, outdoor-centric lifestyle, Fort Myers is your spot.

This is where the rubber meets the road. Let's break down the costs and see who offers the better bang for your buck.

| Category | Philadelphia | Fort Myers | Winner |

|---|---|---|---|

| Median Home Price | $270,375 | $385,000 | Philadelphia |

| Rent (1BR) | $1,451 | $1,331 | Fort Myers |

| Housing Index | 117.8 | 126.7 | Philadelphia |

| Median Income | $60,302 | $61,894 | Fort Myers |

At first glance, the numbers tell a confusing story. Fort Myers has a slightly higher median income and cheaper rent, but a significantly higher median home price. Philadelphia, meanwhile, offers more affordable home ownership but slightly pricier rent.

The Salary Wars: Purchasing Power

Let’s run a scenario. If you earn $100,000 in both cities, where does it feel like more?

Insight: If your priority is buying a home, Philadelphia offers dramatically better value. If you're a high earner focused on maximizing take-home pay and you're okay with renting or buying a smaller place, Fort Myers’s tax structure is a powerful lure.

Verdict: Philadelphia wins for homebuyers on a budget. Fort Myers wins for high-earning renters and those who prioritize tax-free income.

Philadelphia: It’s a buyer-friendly market compared to many major cities. The median home price of $270,375 is accessible for a metro of its size. There’s a healthy mix of historic row homes, modern condos, and single-family homes in the suburbs. Inventory exists, but desirable neighborhoods move quickly. Renting is common, but with $1,451/month for a 1BR, building equity through ownership is a smart long-term play if you can find the right property.

Fort Myers: This is a seller’s market, hands down. The median home price of $385,000 is steep for what you get, driven by high demand from retirees, remote workers, and investors. Inventory is tight, and bidding wars are common. Renting is a viable option, especially for newcomers testing the waters, with a 1BR averaging $1,331. However, the rental market is also competitive. If you’re set on buying, be prepared for a tough search and be ready to move fast.

Verdict: For the average buyer, Philadelphia offers a more accessible and less cutthroat housing market.

Winner: Philadelphia (for walkability and transit options).

Winner: Fort Myers (if you hate cold/snow) or Philadelphia (if you prefer four seasons).

This is a critical area where the data is stark. Using the provided violent crime rates per 100,000 people:

While both rates are above the national average, Philadelphia’s rate is significantly higher. It’s crucial to note that crime in Philly is highly concentrated in specific neighborhoods. Areas like Center City, Society Hill, and many northern suburbs are quite safe. However, the citywide average is a real concern. Fort Myers is safer overall by the numbers, but like any city, it has areas to be cautious about.

Winner: Fort Myers (based on the data).

There is no one-size-fits-all answer. Your perfect city depends entirely on your priorities, life stage, and tolerance for weather and noise.

Philadelphia

Fort Myers

The Bottom Line: Choose Philadelphia if you want an affordable, vibrant, walkable city with deep cultural roots and don’t mind the cold. Choose Fort Myers if you prioritize a warm, relaxed lifestyle, can afford the higher housing costs, and want a safer, tax-friendly environment.