📊 Lifestyle Match

Visualizing the tradeoffs between St. Joseph and Kansas City

Detailed breakdown of cost of living, income potential, and lifestyle metrics.

Visualizing the tradeoffs between St. Joseph and Kansas City

Line-by-line data comparison.

| Category / Metric | St. Joseph | Kansas City |

|---|---|---|

| Financial Overview | ||

| Median Income | $57,205 | $65,225 |

| Unemployment Rate | 4% | 3.5% |

| Housing Market | ||

| Median Home Price | $170,000 | $288,500 |

| Price per SqFt | $115 | $164 |

| Monthly Rent (1BR) | $734 | $1,098 |

| Housing Cost Index | 102.9 | 88.1 |

| Cost of Living | ||

| Groceries Index | 87.7 | 95.0 |

| Gas Price (Gallon) | $3.40 | $3.40 |

| Safety & Lifestyle | ||

| Violent Crime (per 100k) | 542.7 | 1578.0 |

| Bachelor's Degree+ | 19% | 40.3% |

| Air Quality (AQI) | 30 | 28 |

AI-generated analysis based on current data.

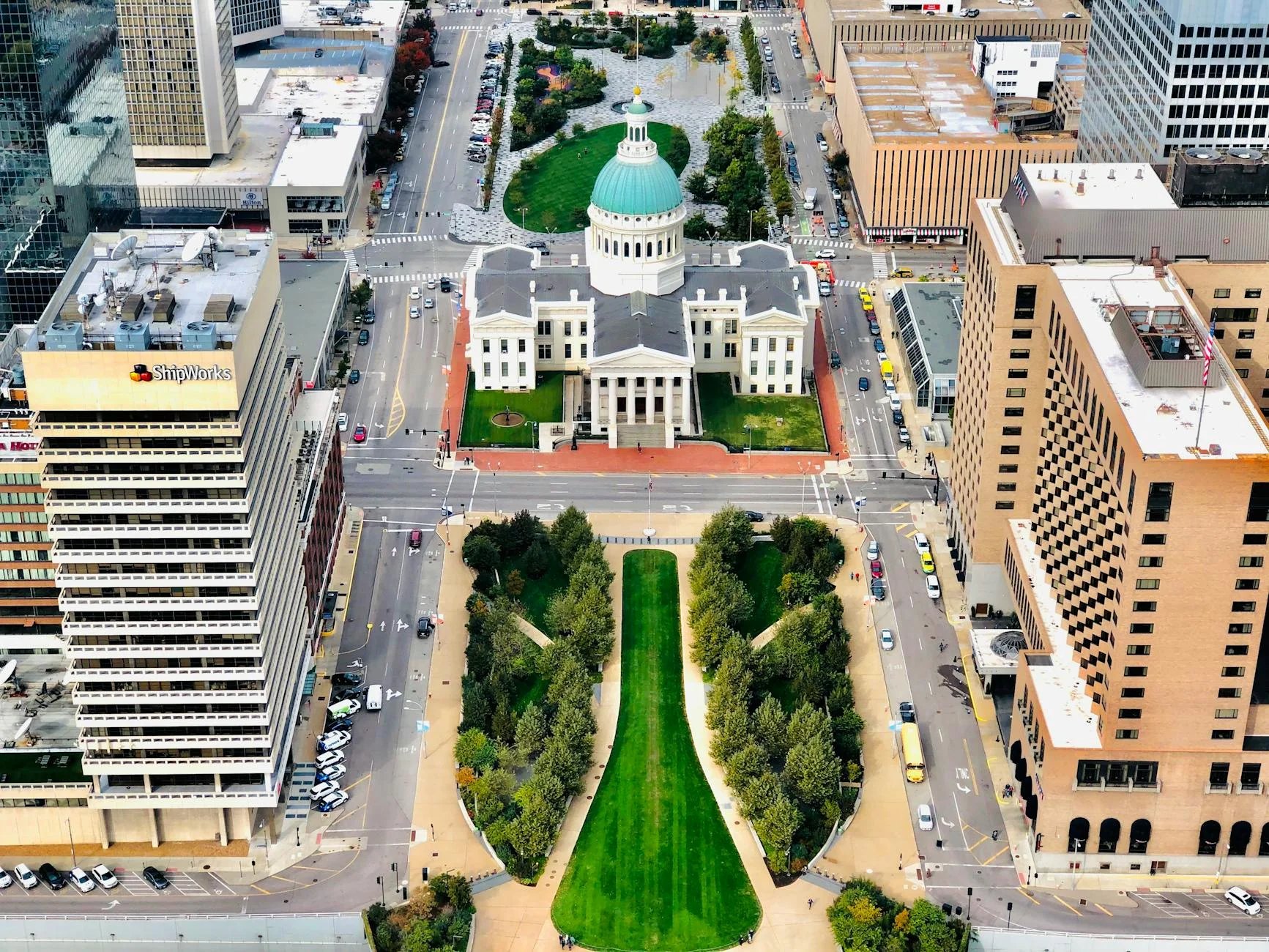

So, you’re looking at Missouri, and two cities keep popping up: Kansas City and St. Joseph. One is a sprawling metro hub of 510,671 people known for jazz, BBQ, and the Chiefs. The other is a historic town of 70,702 folks, a former Wild West outpost that feels like a step back in time.

But which one is right for you? As a relocation expert, I’ve crunched the numbers, talked to locals, and cut through the fluff. This isn’t just about which city is "better"—it’s about which city fits your life.

Let’s dive in.

Kansas City is a beast of a city that behaves like a small town. It’s a Midwestern powerhouse with a skyline that lights up the Missouri River. The vibe here is vibrant but chill. You’ve got the Crossroads Arts District buzzing with galleries, the Power & Light District for nightlife, and Westport for that college-town energy. It’s a city of neighborhoods, each with its own personality. If you crave cultural events, pro sports, and endless dining options, KC is your playground. It’s for the person who wants city amenities without the crushing weight of NYC or Chicago prices.

St. Joseph is the definition of "quiet." Nestled along the Missouri River, it’s a place where history is palpable—think Pony Express origins and Victorian architecture. The pace is slower, the streets are less crowded, and the community feels tight-knit. It’s a city of festivals, mom-and-pop shops, and scenic river walks. If you’re looking to escape the hustle, prioritize community, and enjoy a simpler, more affordable lifestyle, St. Joe might feel like home. It’s for the person who values peace over pace.

Verdict:

Let’s talk money. On paper, Kansas City’s median income ($65,225) is higher than St. Joseph’s ($57,205). But the real question is purchasing power. Where does your hard-earned cash go further?

Here’s the head-to-head on core costs:

| Category | Kansas City | St. Joseph | Winner |

|---|---|---|---|

| Median Home Price | $288,500 | $170,000 | St. Joseph |

| Rent (1BR) | $1,098 | $734 | St. Joseph |

| Housing Index | 88.1 (Below Avg) | 102.9 (Above Avg) | Kansas City |

Let’s unpack this. St. Joseph wins the raw affordability battle hands-down. A $170k home versus $288k is a massive $118,500 difference—that’s a life-changing amount of money for a down payment or monthly budget. Rent is nearly 33% cheaper in St. Joe.

But wait—see that Housing Index? That’s a curveball. The index measures housing costs relative to the national average. Kansas City’s 88.1 means housing is 11.9% cheaper than the U.S. average. St. Joseph’s 102.9 means it’s 2.9% more expensive than the average. How is that possible? It’s all about income disparity.

The Salary Wars & Purchasing Power:

Let’s say you earn the median income in each city:

Insight: While KC has a higher salary and looks cheaper on the index, St. Joseph offers a lower barrier to entry for homeownership. For $100k in St. Joe, you’d feel like a king. In KC, you’d live comfortably, but you’d be firmly middle-class.

Taxes: Missouri has a progressive income tax rate (up to 4.95%), so both cities share similar tax burdens. No major advantage here.

Kansas City: The market is competitive but balanced. With a median home price of $288,500, you get more space, modern amenities, and a wider variety of styles—from historic bungalows to new-build suburbs. Inventory is decent, but desirable neighborhoods (like Brookside or the North Loop) move fast. Renting is a solid option if you’re not ready to commit, with plenty of apartment complexes and renovated historic lofts.

St. Joseph: The market is a buyer’s dream. A median price of $170,000 gets you a lot of house—often a historic Victorian or a spacious ranch in a quiet neighborhood. Competition is minimal; you won’t be in bidding wars. The catch? Inventory is tighter. You’re not choosing from 100 listings; you’re choosing from 15. You’ll need patience to find the right fit, but the payoff is incredible value.

Verdict:

This is where the rubber meets the road.

Traffic & Commute:

Weather:

Both cities face a true Midwest climate. We’re talking hot, humid summers and cold, snowy winters.

Crime & Safety (The Hard Truth):

This is a significant differentiator. We must look at Violent Crime Rate per 100,000 people.

Verdict:

After breaking down the data and the vibes, here’s my professional, opinionated take on which city wins for specific lifestyles.

Why: The trifecta of affordability, safety, and space is unbeatable. A $170k median home price means you can afford a larger house with a yard, which is gold for families. The lower crime rate provides peace of mind, and the small-town community vibe fosters a strong sense of belonging for kids. While KC has excellent suburbs, the entry price and urban safety concerns make St. Joseph a smarter, more stable choice for most families.

Why: The energy, opportunities, and social scene are simply on another level. Kansas City boasts a diverse job market (tech, healthcare, logistics), a thriving arts and food scene, and a dating pool that’s 5x larger than St. Joseph’s. You can live in a walkable neighborhood, hit up a new brewery every weekend, and still have money left over after rent. St. Joseph’s quiet charm can feel isolating if you’re young, single, and hungry for experiences.

Why: Budget-friendly living is the top priority for retirees on a fixed income. With a lower cost of living, cheaper property taxes (based on lower home values), and a slower pace of life, St. Joseph allows retirement savings to stretch much further. The community is welcoming, and you’re never far from amenities like healthcare (St. Joseph’s Heart Center is a regional leader). Kansas City offers more cultural attractions, but the cost and complexity of a large metro can be overwhelming.

Pros:

Cons:

Pros:

Cons:

The Bottom Line:

Choose Kansas City if you’re chasing career growth, urban amenities, and don’t mind navigating the trade-offs of a larger city (traffic, cost, safety in specific areas). It’s the Missouri metropolis with big-city dreams.

Choose St. Joseph if you’re prioritizing financial freedom, safety, and a slower, community-oriented lifestyle. It’s the hidden gem where your dollar screams, and you can own a piece of history without breaking the bank.

The choice isn’t about right or wrong—it’s about what your version of a good life looks like. Now, go find it.