📊 Lifestyle Match

Visualizing the tradeoffs between Baltimore and Phoenix

Detailed breakdown of cost of living, income potential, and lifestyle metrics.

Visualizing the tradeoffs between Baltimore and Phoenix

Line-by-line data comparison.

| Category / Metric | Baltimore | Phoenix |

|---|---|---|

| Financial Overview | ||

| Median Income | $59,579 | $79,664 |

| Unemployment Rate | 4.2% | 4.1% |

| Housing Market | ||

| Median Home Price | $242,250 | $457,000 |

| Price per SqFt | $153 | $278 |

| Monthly Rent (1BR) | $1,582 | $1,599 |

| Housing Cost Index | 116.9 | 124.3 |

| Cost of Living | ||

| Groceries Index | 102.2 | 98.4 |

| Gas Price (Gallon) | $3.40 | $3.40 |

| Safety & Lifestyle | ||

| Violent Crime (per 100k) | 1456.0 | 691.8 |

| Bachelor's Degree+ | 37.1% | 33.5% |

| Air Quality (AQI) | 29 | 39 |

AI-generated analysis based on current data.

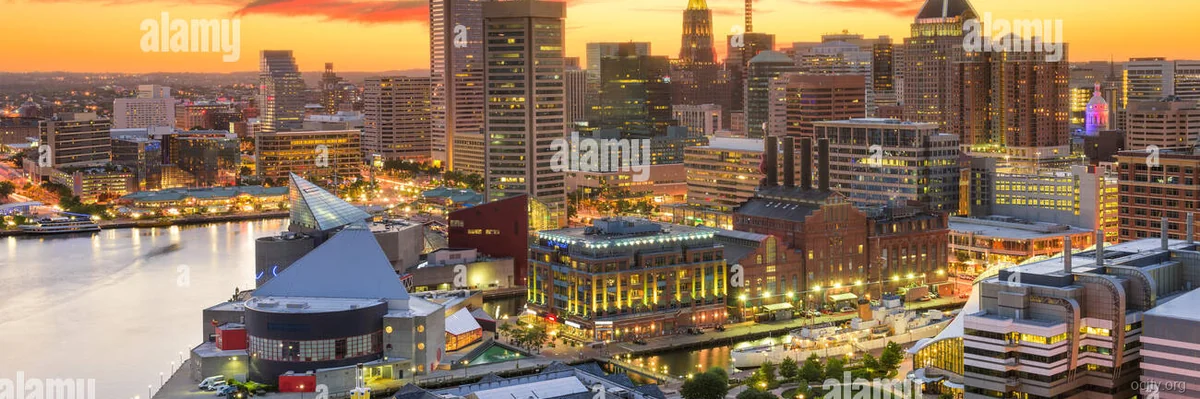

Welcome to the ultimate urban cage match. You’re standing at a crossroads, trying to decide between the gritty, historic charm of Baltimore and the sprawling, sun-drenched metropolis of Phoenix. This isn't just about picking a zip code; it's about choosing a lifestyle.

As your relocation expert, I’m here to cut through the marketing brochures and give you the real data, the straight talk, and the verdict you need. Let's get into it.

First, let's talk about what it feels like to live here.

Baltimore is a Mid-Atlantic beast. It’s a city of distinct, tight-knit neighborhoods, world-class crab cakes, and a soul that’s equal parts blue-collar grit and intellectual horsepower (thanks to Johns Hopkins). This is "Charm City" for a reason: you get historic rowhomes, a walkable urban core, and a genuine sense of place. It’s for the person who wants to live in a real, functioning city with deep roots, not a polished transplant city.

Phoenix, on the other hand, is the capital of the modern Southwest. It’s a beast of urban sprawl, where you can’t go anywhere without a car. The vibe is laid-back, focused on outdoor recreation (in the winter, anyway), and built for people who want space and sunshine. It’s for the person who wants a single-family home with a pool and a two-car garage, and doesn’t mind driving an hour to see their friends.

Let's talk money. Specifically, what your paycheck actually buys you. This is where the story gets interesting.

On the surface, the rent prices are almost identical. You’re looking at $1,582 in Baltimore versus $1,599 in Phoenix for a one-bedroom apartment. A statistical dead heat. But dig a little deeper, and the story changes.

| Expense Category | Baltimore, MD | Phoenix, AZ | The Takeaway |

|---|---|---|---|

| Rent (1BR) | $1,582 | $1,599 | It's a tie. The rent is essentially the same. |

| Housing Index | 102.5 | 102.5 | Another tie. Both are slightly above the US average. |

| Median Income | $59,579 | $79,664 | Phoenix residents earn 33% more on average. |

| State Income Tax | Up to 5.75% (Progressive) | 0% | A massive win for Phoenix. |

Here’s the dealbreaker. If you earn $100,000 in Phoenix, you take home significantly more than your counterpart in Baltimore.

Even though the rent is the same, the Phoenix earner has thousands more in their pocket annually to save, invest, or spend. This creates a powerful illusion. In Phoenix, you feel richer because you are richer after taxes. In Baltimore, that $1,582 rent hurts more because your paycheck is smaller from the jump.

Insight: The "deal" in Baltimore isn't on the rent—it's on the housing stock prices, which we'll get to next. But for pure cash flow and purchasing power? Phoenix has a significant advantage.

This is where the two cities diverge completely.

Baltimore: The Renter's Playground

Baltimore's housing market is complex. It's a city of rowhomes and distinct pockets. While the data for Median Home Price is N/A here, the market is generally more accessible to buy in than Phoenix. However, the high property taxes in Maryland (often over 1% of assessed value) are a bitter pill for homeowners. For this reason, and the sheer inventory of apartments, many people are content to rent long-term in Baltimore. The market isn't on fire with competition like it is elsewhere, giving buyers a bit more breathing room.

Phoenix: The Frenzy of Ownership

Phoenix is a different beast entirely. The median home price sits at a hefty $445,000. Despite high interest rates, this remains a competitive, seller-friendly market. The demand is relentless, driven by a booming population and a desire for single-family living. If you want to buy a house with a yard and a pool, you have to be prepared for a fight. It's a high-stakes game where bidding wars are still a reality. The tradeoff? Arizona's property taxes are generally lower than Maryland's, which helps offset the high purchase price.

This is the part of the article where we stop talking about money and start talking about your sanity.

Let's not sugarcoat this. The data is stark.

After breaking down the data and the lifestyle, the choice becomes clearer based on who you are.

Winner for Families: Phoenix

While the summers are brutal, the combination of a higher median income, 0% state income tax, and the prevalence of single-family homes with yards makes it the practical choice for raising a family. The crime rate is also a major factor.

Winner for Singles/Young Pros: Baltimore

If you want a true city experience—walkable neighborhoods, bars, culture, and a distinct identity—without the soul-crushing cost of a D.C. or NYC, Baltimore is it. The rent is manageable, and the city life is authentic.

Winner for Retirees: Phoenix

This is a slam dunk. The weather (in the winter) is a retiree's dream. The lack of state income tax is a massive boost to a fixed income. The lifestyle is geared towards relaxation and golf, not navigating snowstorms or city grit.

Pros:

Cons:

Pros:

Cons: