📊 Lifestyle Match

Visualizing the tradeoffs between Baltimore and San Antonio

Detailed breakdown of cost of living, income potential, and lifestyle metrics.

Visualizing the tradeoffs between Baltimore and San Antonio

Line-by-line data comparison.

| Category / Metric | Baltimore | San Antonio |

|---|---|---|

| Financial Overview | ||

| Median Income | $59,579 | $62,322 |

| Unemployment Rate | 4.2% | 4.2% |

| Housing Market | ||

| Median Home Price | $242,250 | $264,900 |

| Price per SqFt | $153 | $153 |

| Monthly Rent (1BR) | $1,582 | $1,197 |

| Housing Cost Index | 116.9 | 94.2 |

| Cost of Living | ||

| Groceries Index | 102.2 | 91.9 |

| Gas Price (Gallon) | $3.40 | $2.35 |

| Safety & Lifestyle | ||

| Violent Crime (per 100k) | 1456.0 | 798.0 |

| Bachelor's Degree+ | 37.1% | 30.5% |

| Air Quality (AQI) | 29 | 39 |

AI-generated analysis based on current data.

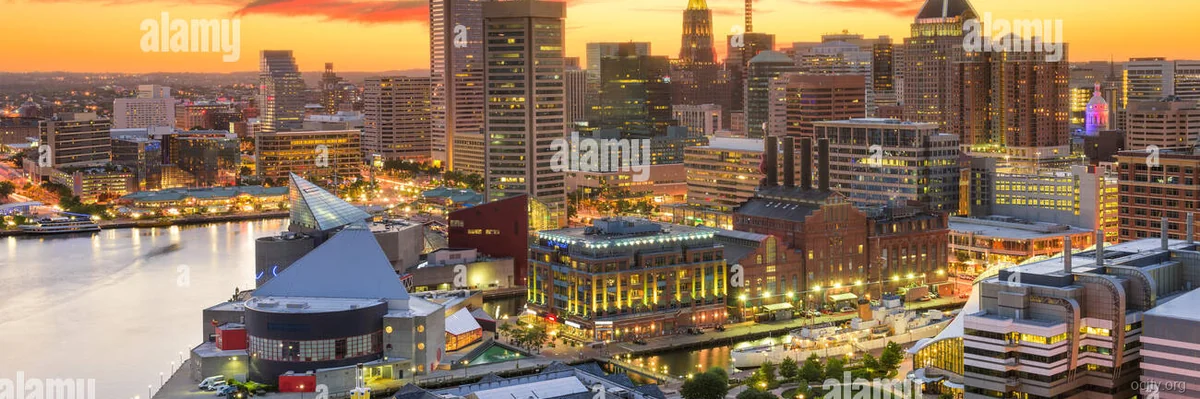

Let's cut to the chase. You're standing at a crossroads, and the two paths couldn't look more different. On one side, you have Baltimore: a gritty, historic East Coast port city with a chip on its shoulder and world-class institutions in its backyard. On the other, San Antonio: a sprawling, sun-drenched cultural hub in the heart of Texas that’s growing faster than a weed in the spring.

Choosing between them isn't just about picking a zip code; it's about choosing a lifestyle. Are you looking for the four distinct seasons and intellectual energy of a major metro, or the year-round backyard BBQ vibe and financial freedom of the Lone Star State?

Buckle up. We're throwing down the ultimate head-to-head showdown to help you decide where to plant your roots.

This is where the personalities clash the hardest.

Baltimore is the definition of a "boomtown" city—it’s got incredible highs and some serious lows. Think of it as the scrappy underdog with a Ph.D. It’s home to Johns Hopkins University and a massive biomedical corridor, meaning it’s packed with researchers, doctors, and lawyers. The culture is deeply East Coast: fast-paced, a little cynical, but fiercely loyal. You'll find historic rowhomes, a legendary food scene (crab cakes are a religion here), and a waterfront that actually feels like a port city. It’s a city of distinct, tight-knit neighborhoods. You don’t just "live in Baltimore"; you live in Hampden, Fells Point, or Charles Village. It’s for the person who wants big-city amenities without the soul-crushing price tag of D.C. or New York.

San Antonio, on the other hand, is a VIBE. It’s the seventh-largest city in America, but it doesn’t feel like a concrete jungle. It’s a city built on a river (literally, the famous River Walk), infused with deep Tejano culture, and anchored by a massive military presence. The pace is slower, more Southern than Northeastern. It’s all about outdoor patios, margaritas, and family. It’s growing so fast that it feels perpetually new, with shiny suburbs popping up everywhere. This is the city for someone who wants space, sun, and a culture that celebrates life with a fiesta.

This is where San Antonio lands a knockout punch, but let's break down the numbers.

If you earn the median income in each city, you’re making about $59,579 in Baltimore versus $62,322 in San Antonio. That’s a wash. But when you factor in the cost of living, the Texas dollar screams ahead.

Here’s how the monthly essentials stack up:

| Category | Baltimore, MD | San Antonio, TX | The Edge |

|---|---|---|---|

| Rent (1BR) | $1,582 | $1,197 | San Antonio |

| Housing Index | 102.5 | 82.5 | San Antonio |

| Utilities | $165 | $155 | San Antonio |

| Groceries | $128 | $118 | San Antonio |

The Purchasing Power Reality Check:

Let’s say you earn $100,000. In Baltimore, that salary gives you a comfortable, but not lavish, middle-class life. You’ll pay state income tax (roughly 4.75%), and your housing budget will be stretched thin if you want to live in a desirable neighborhood.

Now, take that same $100,000 to San Antonio. Texas has a 0% state income tax. That’s an instant $4,750 raise right off the bat. Combine that with rent that is, on average, $400 cheaper per month ($4,800/year), and your purchasing power skyrockets. In San Antonio, a six-figure salary puts you in the top tier of earners, allowing you to afford a large house in a great suburb. In Baltimore, you’re just... doing fine.

Verdict: For sheer financial muscle and bang for your buck, San Antonio wins in a landslide.

San Antonio is a classic "Seller's Market" driven by explosive population growth. The median home price is $285,000, which is incredibly reasonable for a major U.S. city. Inventory moves fast, but new construction is rampant. If you want a three-bedroom, two-bath with a two-car garage and a big lawn, it's within reach for the middle class. The barrier to entry for homeownership is significantly lower.

Baltimore is a more complex beast. There is no reliable median home price because the market is so hyper-local. A pristine historic rowhome in Canton can cost $600,000+, while a structurally sound fixer-upper a mile away might be $120,000. It’s a city of opportunity for savvy investors and first-time buyers who are willing to put in some work, but it’s not a "plug-and-play" housing market like San Antonio. Renting is often the easier, safer path for newcomers.

Verdict: If your goal is to buy a traditional single-family home with a yard, San Antonio is the clear winner. Baltimore offers better deals for the risk-tolerant, but it's a much trickier market to navigate.

This is where the choice gets personal.

Both cities are big and sprawled out, meaning you'll likely be driving. San Antonio’s traffic is no joke, especially on I-10 and Loop 1604, but it’s generally considered less congested than the D.C./Baltimore corridor. Baltimore’s commute can be a breeze if you work in the city, but if you need to get to D.C. for work, the I-95 corridor is one of the most soul-crushing commutes in America.

Here’s the data: Baltimore’s average winter low is 33.0°F. San Antonio’s is a balmy 45.0°F.

But the data doesn't tell the whole story. Baltimore has four real seasons. You get beautiful falls, brutal winters with snow and slush, and humid summers. It’s a classic Mid-Atlantic climate.

San Antonio has two seasons: Hot and Not-Quite-As-Hot. Summer is no joke; expect weeks of 100°F+ heat where you can’t be outside midday. Winter is pleasant, but spring brings brutal thunderstorms and, occasionally, ice. The humidity is a constant factor.

Verdict: Do you prefer shoveling snow or hiding from the sun? It’s a lifestyle choice. San Antonio wins if you crave year-round outdoor activity.

Let's be blunt. This is a major factor.

San Antonio’s violent crime rate is 798.0 per 100k. This is above the national average but is typical for a large, rapidly growing Texas city.

Baltimore’s violent crime rate is 1,456.0 per 100k. This is nearly double that of San Antonio. While the city is a collection of safe, vibrant neighborhoods, the city-wide statistics are undeniably high and represent a significant challenge. Navigating safety in Baltimore requires more research and neighborhood-specific knowledge than in San Antonio.

Verdict: For overall safety and peace of mind, San Antonio is the safer bet.

This isn't about which city is "better," but which city is better for you.

WINNER for Families: San Antonio

The math is simple. For the price of a small, older home in a decent Baltimore neighborhood, you can get a large new build in a top-rated suburban school district in San Antonio with a yard for the kids and a pool. The lower crime rate and family-centric culture seal the deal.

WINNER for Singles & Young Pros: Baltimore

If you're a young professional in medicine, law, or tech, Baltimore’s proximity to D.C., Boston, and NYC is a huge advantage. The social scene in neighborhoods like Fells Point and the Inner Harbor is dense, walkable, and energetic. You'll find more intellectual peers and a faster-paced, East Coast vibe.

WINNER for Retirees: San Antonio

It’s not even close. The 0% income tax on pensions and Social Security is a massive financial benefit. The warmer weather means fewer aches and pains and more days spent on a patio. The cost of living allows retirement savings to go much, much further.

Pros:

Cons:

Pros:

Cons: