📊 Lifestyle Match

Visualizing the tradeoffs between Kent and Chicago

Detailed breakdown of cost of living, income potential, and lifestyle metrics.

Visualizing the tradeoffs between Kent and Chicago

Line-by-line data comparison.

| Category / Metric | Kent | Chicago |

|---|---|---|

| Financial Overview | ||

| Median Income | $85,982 | $74,474 |

| Unemployment Rate | 4.6% | 4.2% |

| Housing Market | ||

| Median Home Price | $635,000 | $365,000 |

| Price per SqFt | $328 | $261 |

| Monthly Rent (1BR) | $1,864 | $1,507 |

| Housing Cost Index | 151.5 | 110.7 |

| Cost of Living | ||

| Groceries Index | 107.9 | 103.3 |

| Gas Price (Gallon) | $3.65 | $3.40 |

| Safety & Lifestyle | ||

| Violent Crime (per 100k) | 456.0 | 819.0 |

| Bachelor's Degree+ | 33% | 45.7% |

| Air Quality (AQI) | 63 | 38 |

AI-generated analysis based on current data.

So, you’re standing at a crossroads. On one side, you have the Windy City—a legendary, gritty, no-nonsense metropolis that’s the beating heart of the Midwest. On the other, Kent—a sleek, fast-growing hub that’s part of the Seattle metro area, offering a different flavor of urban living.

Choosing between them isn't just about picking a dot on the map; it’s about picking a lifestyle. Are you chasing the electric buzz of a global city, or the calculated balance of a tech-savvy suburb with city perks? Let’s cut through the noise, crunch the numbers, and see which one wins your heart (and your wallet).

Chicago is a city that doesn’t ask for permission. It’s a powerhouse of culture, food, and architecture. The vibe is unpretentious but deeply proud. You’ll find world-class museums, a legendary food scene (deep dish is just the start), and a summer that feels like a reward after a brutal winter. It’s a city of distinct neighborhoods, each with its own personality. It’s for the person who craves energy, diversity, and the feeling of living in a place that truly never sleeps.

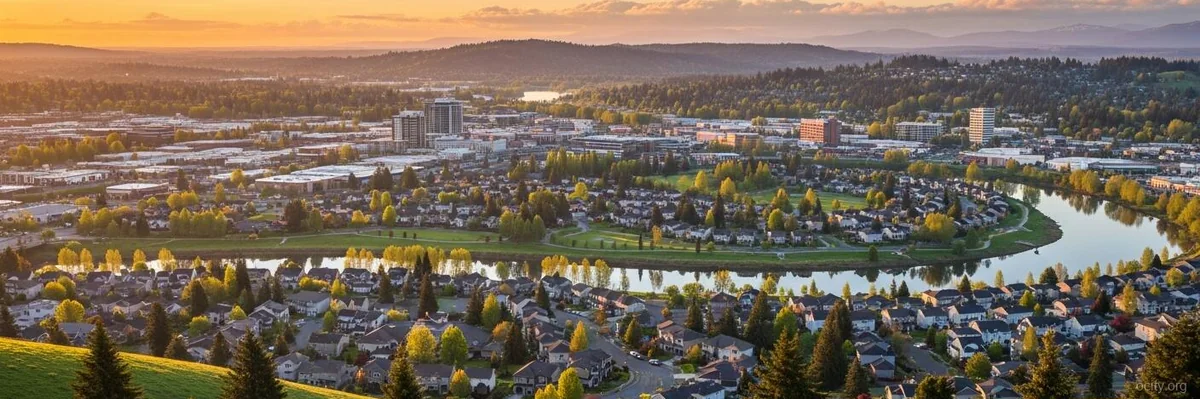

Kent, on the other hand, is the definition of Pacific Northwest sophistication. It’s a tech-forward city that sits in the shadow of Seattle, offering a more manageable, cleaner, and greener alternative. The vibe is active, outdoorsy, and tech-driven. It’s for the professional who wants easy access to major career opportunities (Amazon, Microsoft) without the chaos of downtown Seattle. It’s a place where you can hike in the morning and be in a tech meeting by lunch.

Who is it for?

This is where the rubber meets the road. Your salary buys a very different lifestyle in these two cities.

Let’s break down the monthly expenses. We’re using the provided data to build a snapshot.

| Category | Chicago | Kent | Winner |

|---|---|---|---|

| Median Income | $74,474 | $85,982 | Kent |

| Median Home Price | $365,000 | $635,000 | Chicago |

| Rent (1BR) | $1,507 | $1,864 | Chicago |

| Housing Index | 110.7 | 151.5 | Chicago |

| Violent Crime/100k | 819.0 | 456.0 | Kent |

| Avg. Jan Temp | 21.0°F | 48.0°F | Kent |

The Salary Wars & Purchasing Power:

At first glance, Kent’s median income looks tempting—it’s about $11,500 higher. But let’s talk purchasing power. The housing market is the great equalizer.

In Chicago, the median home price is $365,000. If you earn the median income of $74,474, your home is roughly 4.9x your annual salary. This is on the high side but within the realm of possibility for a dual-income household or a high-earning professional.

In Kent, the median home price is a staggering $635,000. With a median income of $85,982, that home is 7.4x your salary. That’s a massive gap. To afford that Kent home on a single median income, you’d need a much larger down payment and would be severely "house poor."

The Tax Twist:

Illinois has a flat state income tax of 4.95%, and Chicago has its own additional sales tax. Washington State has 0% personal income tax, which is a huge perk. However, Washington makes up for it with a high sales tax (over 10% in many areas) and some of the highest gas prices in the nation.

Verdict on Purchasing Power: While Kent has higher nominal salaries, the cost of living—especially housing—eats up that advantage. Chicago offers significantly more bang for your buck. You can live comfortably on a moderate salary in Chicago, whereas in Kent, you’ll need a high income just to keep up with housing costs.

Chicago: A Renter’s Market (with Buying Potential)

With a Housing Index of 110.7, Chicago is above the national average but is a world away from Kent's 151.5. The rent is lower, and the buying market is more accessible. You can find a decent condo or a single-family home in many neighborhoods for under $400k. The market is competitive but not cutthroat. It’s a classic buyer’s market in many areas, giving you room to negotiate.

Kent: The Competitive Squeeze

Kent is a classic example of a Pacific Northwest housing crunch. The index of 151.5 screams "expensive." Renting is your only real option unless you have a significant down payment or a very high dual income. The median home price of $635,000 puts homeownership out of reach for many singles and young families. Expect bidding wars and a fast-paced, seller-friendly market.

The Dealbreaker: If owning a home is your American Dream, Chicago is the clear winner. Kent’s market is for those with deep pockets or who are willing to rent indefinitely.

Traffic & Commute:

Weather:

Crime & Safety:

This is a tough one. The data is stark.

Verdict on Safety: Kent has a statistically lower crime rate, which is a significant point in its favor for families and those prioritizing security.

After weighing the data, the lifestyle, and the dollars, here’s the final breakdown.

The Bottom Line: Choose Chicago if you value affordability, culture, and a classic urban experience, and can handle the cold and crime. Choose Kent if you’re a high-earning professional (especially in tech) who prioritizes mild weather, safety, and outdoor access, and can afford the premium housing market.