📊 Lifestyle Match

Visualizing the tradeoffs between Lubbock and Philadelphia

Detailed breakdown of cost of living, income potential, and lifestyle metrics.

Visualizing the tradeoffs between Lubbock and Philadelphia

Line-by-line data comparison.

| Category / Metric | Lubbock | Philadelphia |

|---|---|---|

| Financial Overview | ||

| Median Income | $54,451 | $60,302 |

| Unemployment Rate | 4.2% | 4.7% |

| Housing Market | ||

| Median Home Price | $235,000 | $270,375 |

| Price per SqFt | $141 | $204 |

| Monthly Rent (1BR) | $931 | $1,451 |

| Housing Cost Index | 77.2 | 117.8 |

| Cost of Living | ||

| Groceries Index | 91.9 | 100.3 |

| Gas Price (Gallon) | $2.35 | $3.40 |

| Safety & Lifestyle | ||

| Violent Crime (per 100k) | 678.0 | 726.5 |

| Bachelor's Degree+ | 33.2% | 35.7% |

| Air Quality (AQI) | 35 | 40 |

AI-generated analysis based on current data.

Let's settle this. You're staring down two completely different American cities: the gritty, historic, fast-paced East Coast beast that is Philadelphia, and the wide-open, sun-soaked, laid-back West Texas hub of Lubbock.

This isn't just a choice between a cheesesteak and a taco; it's a choice between lifestyles, climates, and economic realities. As your Relocation Expert & Data Journalist, I'm here to cut through the noise, crunch the numbers, and give you the unvarnished truth about where you should plant your roots.

Let's get into it.

Philadelphia is a city with a chip on its shoulder and a chip on its plate. It’s the underdog of the Northeast. You feel the history in the cobblestones of Old City, the weight of the Liberty Bell, and the passion of a Philly sports fan. It’s a major metro area (1.5 million people) that feels like a collection of distinct, tight-knit neighborhoods. The vibe is fast, direct, and unapologetic. It’s for the person who craves culture, walkability, professional opportunities, and a city that never feels asleep.

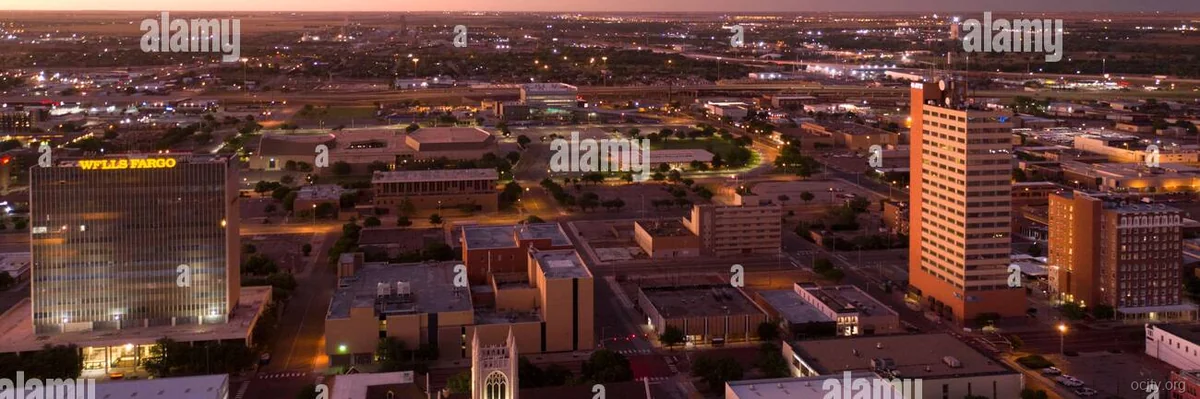

Lubbock is the definition of wide-open spaces. With a population under 270,000, it’s the economic and cultural hub of the South Plains. The vibe is decidedly slower, friendlier, and rooted in community. It’s the heart of Texas country music, a college town (Texas Tech), and a center for cotton and agriculture. It’s for the person who wants a lower cost of living, a shorter commute, and a life where the horizon is always visible. It’s for those who value space over skyscrapers.

Who is it for?

This is where the rubber meets the road. Let's talk purchasing power—the real-world feel of your paycheck.

The Tax Twist: This is a massive, often overlooked factor. Pennsylvania has a flat state income tax of 3.07%. Texas has 0% state income tax. That’s a huge deal. If you earn $100,000, you keep about $3,070 more in Lubbock right off the bat before we even talk about cost of living. That’s a vacation, a car payment, or a significant boost to savings.

Now, let's look at the monthly costs. We'll compare a typical one-bedroom apartment and core expenses. (Note: Housing Index is a benchmark where 100 is the national average).

| Expense Category | Philadelphia | Lubbock | The Takeaway |

|---|---|---|---|

| Median Home Price | $270,375 | $235,000 | Lubbock is about 13% cheaper to buy a home. |

| Rent (1BR) | $1,451 | $931 | Lubbock rent is a staggering 36% cheaper. That's $520/month back in your pocket. |

| Housing Index | 117.8 | 77.2 | Philly's housing is 17.8% above the national average; Lubbock's is 22.8% below. |

| Utilities | ~$180 | ~$220 | Lubbock's extreme heat can spike A/C bills, but it's often offset by milder heating costs. |

| Groceries | ~11% above nat'l avg | ~5% below nat'l avg | Everyday shopping is noticeably cheaper in Lubbock. |

Salary Wars & Purchasing Power:

Let's take that $100,000 salary. In Lubbock, your $0 state income tax and drastically lower rent mean your money goes much, much further. You could afford a nicer apartment, save for a down payment faster, or simply have more disposable income.

In Philadelphia, that same $100,000 feels tighter. The 3.07% state tax and higher rent eat into your budget. You're paying a premium for urban access. However, Philadelphia's median income ($60,302) is higher than Lubbock's ($54,451), indicating a more robust job market with higher earning potential, especially in sectors like healthcare, education, and tech.

Verdict on Dollar Power: For sheer purchasing power and keeping more of what you earn, Lubbock wins decisively. The 0% state income tax and lower housing costs create a financial runway that Philly can't match. However, if you're in a high-earning field where Philly salaries are significantly higher, you could still come out ahead.

Philadelphia:

The market is competitive. With a Housing Index of 117.8, you're paying a premium for the location. The median home price sits at $270,375, but in desirable neighborhoods like Fishtown or Graduate Hospital, expect to pay well over $400,000. It's more of a seller's market in the hot zones, with buyers often facing bidding wars. Renting is the norm for many young professionals, but the rental market is also tight and expensive.

Lubbock:

This is a buyer's market in many respects. The Housing Index of 77.2 tells you housing is a bargain compared to the national average. The median home price of $235,000 gets you a significant amount of space—often a single-family home with a yard, something that’s a luxury in Philadelphia. With lower prices and less intense competition, your dream of homeownership is far more attainable here. Rent is also plentiful and affordable.

Verdict on Housing: For affordability and the path to homeownership, Lubbock is the clear winner. You get more bang for your buck, literally. Philly offers urban living at a cost.

Traffic & Commute:

Weather:

Crime & Safety:

Verdict on Dealbreakers: This is a tie, depending on your priorities. If you hate traffic and extreme heat, Lubbock wins. If you can't stand long commutes and value seasonal change, Philadelphia might be better. Safety is a serious concern in both, though Philly's scale makes the issue more complex.

After breaking down the data, the culture, and the costs, here’s the final showdown tally.

🏆 Winner for Families: LUBBOCK

For a family where a single family home with a yard is a priority, Lubbock is the winner. The cost of living allows for a higher quality of life on a middle-income salary. You'll get more space, safer suburban-style neighborhoods, and a strong sense of community. The trade-off is fewer urban cultural amenities and extreme summer heat.

🏆 Winner for Singles/Young Professionals: PHILADELPHIA

If you're in your 20s or 30s, crave a vibrant social scene, networking opportunities, and walkable neighborhoods, Philadelphia is the place. The higher earning potential in diverse industries, endless restaurants, bars, museums, and sports culture offer an urban experience Lubbock can't match. You'll pay for it, but the energy is undeniable.

🏆 Winner for Retirees: LUBBOCK

For retirees on a fixed income, Lubbock is a financial godsend. The 0% state income tax stretches retirement savings, and the lower cost of living means your nest egg goes further. The mild winters are a plus, though the hot summers are a consideration. The slower pace and friendly community are also major draws. Philadelphia's higher costs and more intense environment can be challenging on a fixed budget.

PROS:

CONS:

PROS:

CONS:

The Bottom Line: Your choice boils down to a fundamental trade-off: Urban Energy vs. Financial Freedom. Do you want the hustle, history, and amenities of a major East Coast city, even if it costs you more? Or do you want the financial breathing room, space, and slower pace of West Texas, even if it means fewer big-city perks?

Choose wisely. Your wallet—and your lifestyle—will thank you.