📊 Lifestyle Match

Visualizing the tradeoffs between Queen Creek and Chicago

Detailed breakdown of cost of living, income potential, and lifestyle metrics.

Visualizing the tradeoffs between Queen Creek and Chicago

Line-by-line data comparison.

| Category / Metric | Queen Creek | Chicago |

|---|---|---|

| Financial Overview | ||

| Median Income | $135,444 | $74,474 |

| Unemployment Rate | 4.3% | 4.2% |

| Housing Market | ||

| Median Home Price | $612,490 | $365,000 |

| Price per SqFt | $255 | $261 |

| Monthly Rent (1BR) | $1,424 | $1,507 |

| Housing Cost Index | 124.3 | 110.7 |

| Cost of Living | ||

| Groceries Index | 98.4 | 103.3 |

| Gas Price (Gallon) | $3.40 | $3.40 |

| Safety & Lifestyle | ||

| Violent Crime (per 100k) | 449.3 | 819.0 |

| Bachelor's Degree+ | — | 45.7% |

| Air Quality (AQI) | 61 | 38 |

AI-generated analysis based on current data.

You’re standing at a crossroads between two worlds. On one side, you have Chicago—the Windy City—a sprawling, gritty, cultural powerhouse with deep-dish pizza and skyscrapers that claw at the clouds. On the other, you have Queen Creek—a sun-drenched, master-planned suburb in the Phoenix metro area where life moves at a slower, quieter, and distinctly more suburban rhythm.

Choosing isn’t just about picking a city; it’s about picking a lifestyle. One is an adrenaline shot. The other is a long, cool drink of water. Let’s break down this head-to-head battle with data, grit, and a straight talk that cuts through the marketing brochures.

Chicago is a heavyweight champion of American cities. It’s a 2.6 million person coliseum of art, architecture, food, and relentless energy. The vibe here is classic urban. You navigate by train, walk to a corner deli, and feel the pulse of global commerce beat in the Loop. It’s for the person who craves a world at their doorstep—museums, Broadway-caliber theater, pro sports, and a dining scene that rivals New York. It’s a city of distinct neighborhoods, each with its own character, from the hipster havens of Wicker Park to the old-world charm of Lincoln Park.

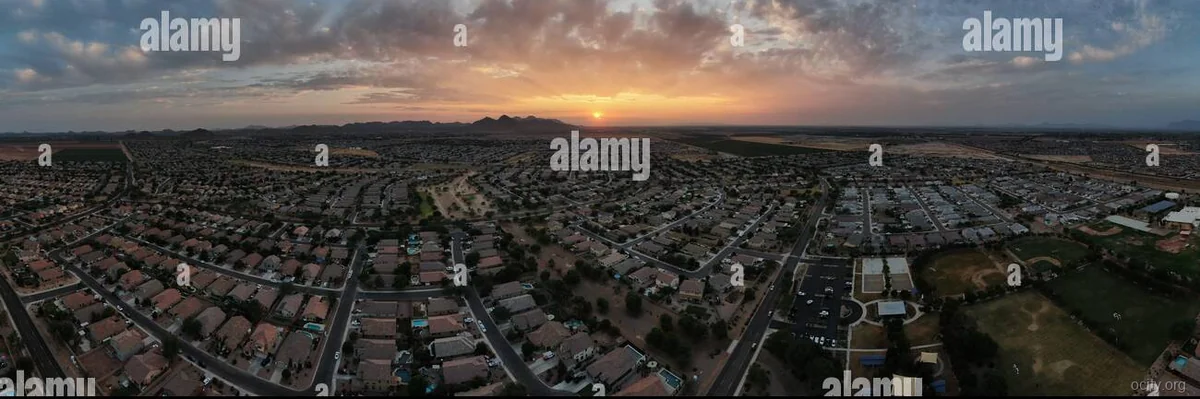

Queen Creek, with its 76,000 residents, is the definition of modern suburban living. It’s a place of wide sidewalks, new-build homes with three-car garages, and community pools. The lifestyle is outward-facing and car-centric. You drive to the grocery store, drive to the hiking trail, and drive to the arena complex for a concert. It’s for the person who prioritizes space, peace, and sunshine over the chaotic energy of a downtown core. The vibe is family-focused, quiet, and brand-new.

Who’s it for?

This is where the rubber meets the road. Let’s talk purchasing power. You might see a higher median income in Queen Creek, but the cost of living tells a more nuanced story.

| Category | Chicago, IL | Queen Creek, AZ | The Takeaway |

|---|---|---|---|

| Median Income | $74,474 | $135,444 | Queen Creek residents earn 82% more on paper. |

| Median Home Price | $365,000 | $612,490 | Chicago is $247k cheaper to buy a home. |

| Rent (1BR) | $1,507 | $1,424 | Surprisingly close, but Chicago rent is 6% higher. |

| Housing Index | 110.7 | 124.3 | Queen Creek is 12% more expensive for housing overall. |

| Violent Crime | 819.0/100k | 449.3/100k | Queen Creek is 45% safer by this metric. |

| Avg. Winter Temp | 21.0°F | 50.0°F | Queen Creek is 29°F warmer in winter. |

The Salary Wars & Purchasing Power

If you earn $100,000 in Chicago, your money goes a surprisingly long way, especially on housing. The median home price is $365,000, which is an incredible deal for a major metro. In Queen Creek, that same $100k feels tighter because the median home price is a staggering $612,490.

Here’s the brutal math: To afford a median home in Queen Creek, you need a household income of roughly $175,000+. In Chicago, that same home is accessible on a $100,000 salary. This is the purchasing power paradox. Queen Creek has higher incomes, but the cost of entry (especially for homeownership) is steep.

The Tax Angle:

Illinois has a flat 4.95% state income tax. Arizona has a graduated income tax that ranges from 2.5% to 4.5%. While Arizona's top rate is lower, the real kicker is property taxes. Illinois has notoriously high property taxes, which can add $6,000-$10,000+ annually to a home's cost. Arizona's property taxes are comparatively lower. This is a dealbreaker for homeowners in Chicago.

Verdict on Dollar Power:

Chicago:

Queen Creek:

The Bottom Line: If you want to buy a home without a brutal bidding war, Chicago offers more breathing room and a lower price point. Queen Creek’s market requires a higher budget and more patience.

This section makes or breaks the decision for many people.

Traffic & Commute:

Weather:

Crime & Safety:

Verdict on Dealbreakers:

After crunching the numbers and measuring the vibes, here’s the final breakdown.

Why: It’s a no-brainer. The lower crime rate, newer schools, abundant parks, and family-centric community design are tailor-made for kids. While the home prices are high, the median income supports it. You’re trading urban excitement for suburban safety and space. The $135k median income goes far here if you own a home.

Why: The purchasing power is king. A young professional earning $80k-$100k can afford a cool apartment in a vibrant neighborhood like Logan Square or Wicker Park. The social, dating, and career opportunities in a global city are unmatched. The energy is infectious, and the cost of entry (rent) is manageable compared to other major metros like NYC or SF.

Why: This is the toughest call.

PROS:

CONS:

PROS:

CONS:

The Final Word:

If your heart beats for the city, your budget is moderate, and you can handle a real winter, Chicago offers an incredible lifestyle with surprising affordability. If you’re building a life centered on family, safety, and sunshine, and you have the income to support a higher housing cost, Queen Creek is your suburban paradise. Choose wisely.