📊 Lifestyle Match

Visualizing the tradeoffs between Queen Creek and Los Angeles

Detailed breakdown of cost of living, income potential, and lifestyle metrics.

Visualizing the tradeoffs between Queen Creek and Los Angeles

Line-by-line data comparison.

| Category / Metric | Queen Creek | Los Angeles |

|---|---|---|

| Financial Overview | ||

| Median Income | $135,444 | $79,701 |

| Unemployment Rate | 4.3% | 5.5% |

| Housing Market | ||

| Median Home Price | $612,490 | $1,002,500 |

| Price per SqFt | $255 | $616 |

| Monthly Rent (1BR) | $1,424 | $2,006 |

| Housing Cost Index | 124.3 | 173.0 |

| Cost of Living | ||

| Groceries Index | 98.4 | 107.9 |

| Gas Price (Gallon) | $3.40 | $3.98 |

| Safety & Lifestyle | ||

| Violent Crime (per 100k) | 449.3 | 732.5 |

| Bachelor's Degree+ | — | 39.2% |

| Air Quality (AQI) | 61 | 52 |

AI-generated analysis based on current data.

So, you're torn between the sprawling, star-studded metropolis of Los Angeles and the rising suburban star of Queen Creek, Arizona. This isn't just a choice between two cities—it's a choice between two entirely different philosophies of living. One is a high-energy, global hub where dreams are chased (and often paid for with your sanity), and the other is a master-planned community where you chase a more predictable, family-centric version of the American Dream.

As someone who crunches the numbers and lives the lifestyle, I'm here to lay it all out on the table. Grab a coffee, because we're about to dive deep into the data, the vibe, and the real-world trade-offs.

Los Angeles is a beast. It's not just a city; it's a constellation of neighborhoods, each with its own dialect, traffic patterns, and culinary scene. The vibe is fast-paced, competitive, and endlessly diverse. You can find a world-class museum, a hole-in-the-wall taco stand, and a networking event for your niche industry all in the same afternoon. It’s for the go-getters, the creatives, the hustlers, and anyone who thrives on the energy of a global city. The downside? That energy is relentless. The "hustle" culture can be exhausting, and the sheer size means you often feel like you're living in a cluster of suburbs that happens to have a downtown.

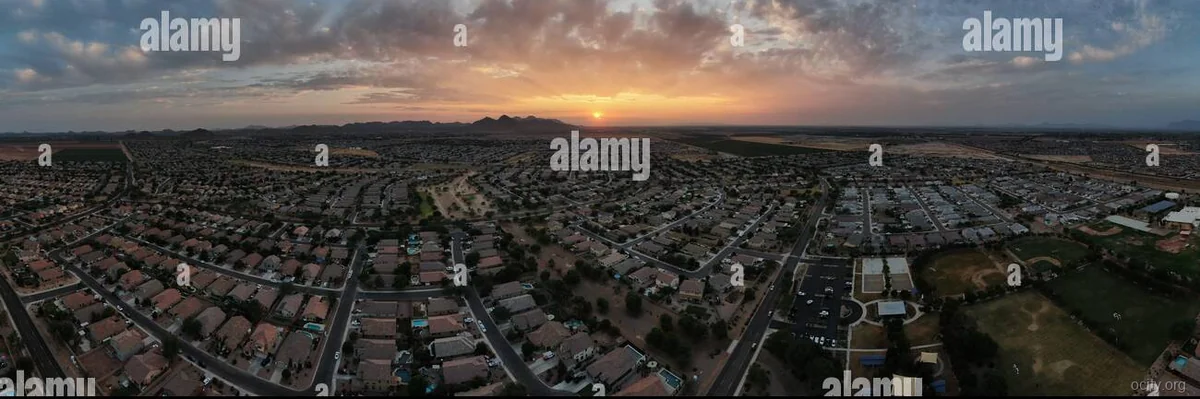

Queen Creek is the antithesis. It’s a textbook example of modern suburban living, meticulously planned with schools, parks, and shopping centers in neat, accessible grids. The vibe is family-oriented, spacious, and quiet. It’s for those who prioritize a backyard, a short commute (to a local office park), and a sense of community where neighbors know each other. The pace is slower, the air is clearer, and the focus is squarely on quality of life. It's ideal for those who've "done" the city life and are ready for a chapter that's more about stability and space than endless stimulation.

Who is each city for?

This is where the rubber meets the road. You might have heard that salaries are higher in LA, but the real question is: what's your purchasing power? Let's break down the cold, hard numbers.

| Category | Los Angeles, CA | Queen Creek, AZ | Winner (Lower Cost) |

|---|---|---|---|

| Median Home Price | $1,002,500 | $612,490 | Queen Creek (by 39%) |

| Rent (1BR) | $2,006 | $1,424 | Queen Creek (by 29%) |

| Housing Index | 173.0 (73% above U.S. avg) | 124.3 (24.3% above U.S. avg) | Queen Creek |

| Population | 3,820,963 | 76,046 | N/A (Scale Difference) |

Salary Wars & The Tax Factor

Let's play a game. You earn $100,000 annually in both locations.

In Los Angeles: You're making slightly above the city's median income. After California's high state income tax (ranging from 1% to 13.3%), you'll take home roughly $72,000 - $74,000. Now, apply that to a median home price of $1,002,500. Your mortgage payment (with 20% down) would be over $5,000/month, which is likely 65-70% of your take-home pay. This is financially unsustainable for most single earners. You'd need a dual income or a much higher salary to comfortably own here.

In Queen Creek: You're making well above the city's median income. Arizona has a relatively low state income tax (top bracket is 2.5%). Your take-home on $100,000 would be closer to $76,000 - $78,000. Apply that to a median home price of $612,490. Your mortgage payment (with 20% down) would be around $3,000/month, or roughly 40-45% of your take-home pay. This is tight but manageable, especially with a partner contributing.

The Insight: While LA offers higher salary potential in specific industries, the tax burden and housing costs are so extreme that they devour your purchasing power. In Queen Creek, your $100k salary stretches dramatically further, especially if you're looking to buy a home. The lack of state income tax in Arizona is a massive, immediate boost to your daily cash flow compared to California.

Los Angeles: The Endless Seller's Market

The LA housing market is a pressure cooker. With a population of nearly 4 million and limited space for new construction, demand perpetually outstrips supply. You're not just buying a house; you're buying into a competitive arena. Bidding wars are standard, all-cash offers are common, and contingencies are often waived. Renting is also fiercely competitive. The $2,006 median rent for a 1BR is just an average; desirable neighborhoods can be 30-50% higher. For most, buying in LA is a long-term, high-stakes investment that often requires generational wealth or a massive dual income. Renting is the more feasible (but still expensive) option for the majority.

Queen Creek: A Competitive, But Accessible Market

Queen Creek's market is hot, but it's a different kind of heat. It's a seller's market driven by in-migration from more expensive states (like California itself). Homes sell quickly, but the entry price is significantly lower. The median home price of $612,490 gets you a modern, single-family home with a yard—something that would be a multi-million dollar property in most of LA. The competition is intense, but you're not competing with hedge funds and celebrities. It's mostly families and professionals. Renting is also more accessible, with the $1,424 median rent offering more space for your money than in LA. The market is appreciating quickly, making it a good time to buy if you plan to stay for 5+ years.

After breaking down the data and the lifestyle, here's the final showdown verdict.

Why: It's not even a contest. The combination of significantly lower housing costs, excellent public schools (a major draw for the area), a safe community feel, and a slower pace of life makes Queen Creek the clear choice for raising a family. You get a bigger house, a yard, and a community of families. The financial breathing room allows for savings, vacations, and college funds. LA can be a fantastic place to raise kids if you have the resources, but for the average family, Queen Creek offers a far more stable and enriching environment.

Why: If you're in your 20s or early 30s, career-driven, and crave energy, diversity, and networking opportunities, Los Angeles is the unparalleled playground. The sheer density of people, industries, and experiences is a massive advantage. You can climb the ladder in entertainment, tech, or design, and your social life will never be boring. Yes, you'll pay for it financially and in traffic, but the professional and personal growth opportunities are immense. Queen Creek's social scene for singles can feel limited.

Why: For retirees, financial security and a comfortable, predictable lifestyle are paramount. Queen Creek's lower cost of living (especially no state income tax on Social Security and pensions) means retirement savings go much further. The warm, dry winters are easy on the joints, and the active adult communities are plentiful. The safe, quiet, and walkable (in parts) environment is ideal for enjoying the golden years. LA's energy can be overwhelming, and the high costs can drain a fixed income rapidly.

PROS:

CONS:

PROS:

CONS:

The Bottom Line: Choose Los Angeles if your career is your priority and you thrive on energy and diversity. Choose Queen Creek if your family and financial stability are your top priorities, and you're willing to trade cultural density for open space and a higher quality of life. The data doesn't lie—your dollar goes much further in Arizona, but the soul of LA is in a league of its own.