📊 Lifestyle Match

Visualizing the tradeoffs between St. Louis and San Diego

Detailed breakdown of cost of living, income potential, and lifestyle metrics.

Visualizing the tradeoffs between St. Louis and San Diego

Line-by-line data comparison.

| Category / Metric | St. Louis | San Diego |

|---|---|---|

| Financial Overview | ||

| Median Income | $56,245 | $105,780 |

| Unemployment Rate | 4% | 4.9% |

| Housing Market | ||

| Median Home Price | $235,000 | $930,000 |

| Price per SqFt | $151 | $662 |

| Monthly Rent (1BR) | $972 | $2,248 |

| Housing Cost Index | 102.9 | 185.8 |

| Cost of Living | ||

| Groceries Index | 87.7 | 103.5 |

| Gas Price (Gallon) | $3.40 | $3.98 |

| Safety & Lifestyle | ||

| Violent Crime (per 100k) | 1927.0 | 378.0 |

| Bachelor's Degree+ | 45.1% | 52% |

| Air Quality (AQI) | 44 | 25 |

AI-generated analysis based on current data.

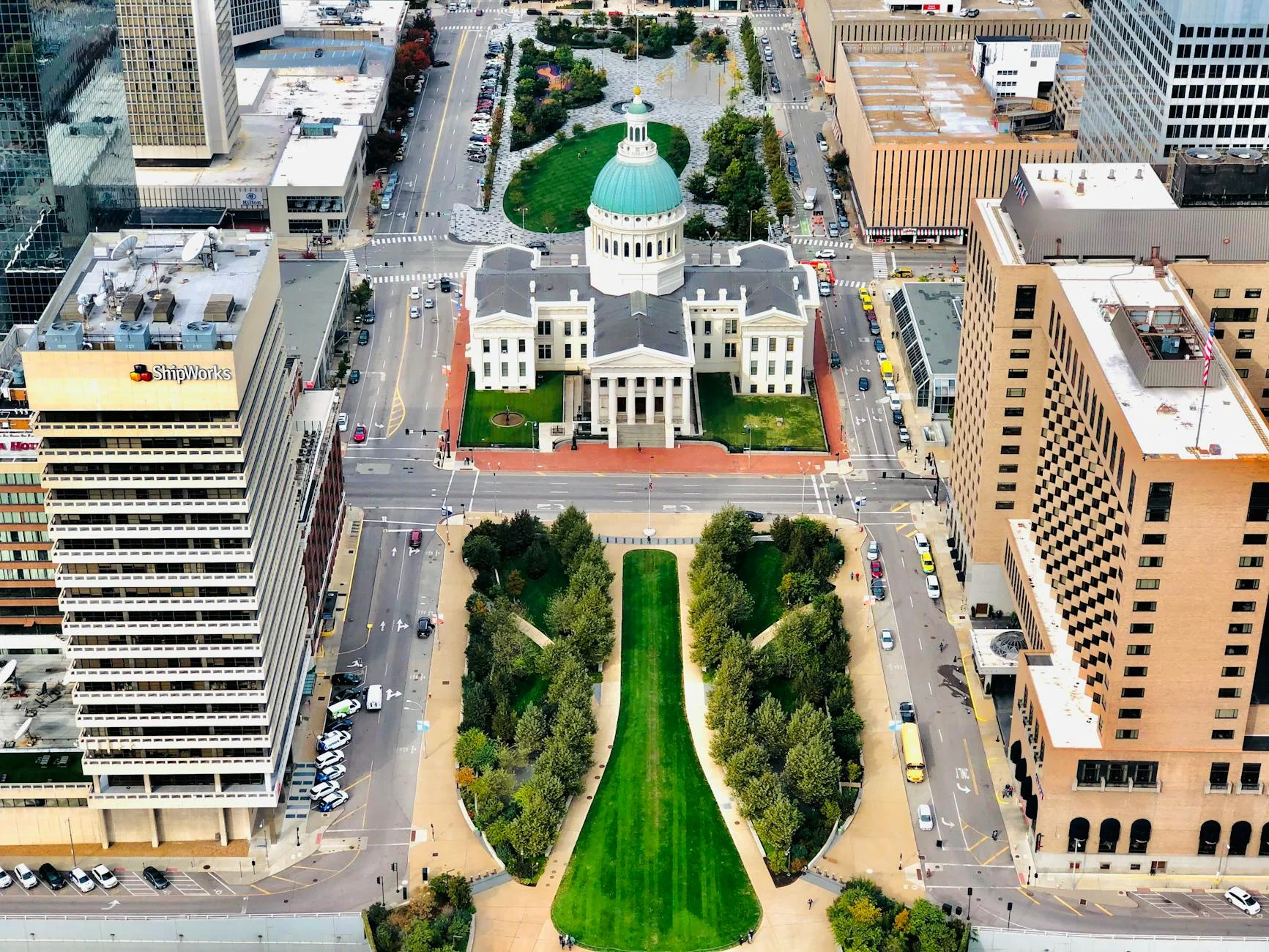

Alright, let's cut through the noise. You're standing at a crossroads, looking at two radically different American cities. On one side, you have San Diego—the sun-drenched, laid-back coastal metropolis with a price tag that might make your eyes water. On the other, St. Louis—the gritty, affordable gateway to the Midwest, a city with a rich history but a reputation that often precedes it.

This isn't just about geography. It's about lifestyle, budget, and what you value most. Are you chasing the California dream, or are you looking for a place where your dollar stretches to the moon? Grab a coffee (or a craft beer) and let's dive into this head-to-head battle. We're going to break it down with hard data, real talk, and no sugar-coating.

San Diego is the cool, effortlessly stylish friend who seems to have it all figured out. The vibe here is unapologetically relaxed. It's the epicenter of Southern California's beach culture, where the day starts with a sunrise surf session and ends with a tacos-and-beers sunset. The "San Diego Way" is about balancing work and play—think tech, biotech, and military jobs, but with a strong emphasis on outdoor living. It’s for the person who believes a Tuesday afternoon hike in Torrey Pines is non-negotiable.

St. Louis, on the other hand, is the friend with a complex past and a heart of gold. It's a city of neighborhoods, each with its own distinct character, from the historic brick row houses of South City to the revitalized warehouse districts. The vibe is more "blue-collar meets white-collar," with a thriving arts scene, legendary food (hello, toasted ravioli), and a deep sense of community. It’s a city that’s been down but never out, with a fiercely proud culture. It’s for the person who appreciates history, values substance over flash, and doesn’t mind a few clouds in exchange for affordability.

Who's it for?

This is where the rubber meets the road. The "sticker shock" in San Diego is real, but so is the earning potential. In St. Louis, the numbers look modest, but the purchasing power can be staggering. Let's put them side-by-side.

| Category | San Diego (Index) | St. Louis (Index) | The Story |

|---|---|---|---|

| Housing | 185.8 | 102.9 | San Diego's housing is 85% above the national average. St. Louis is virtually at the national average. This is the single biggest differentiator. |

| Rent (1BR) | $2,248 | $972 | You could nearly rent two and a half apartments in St. Louis for the price of one in San Diego. |

| Utilities | ~16% above avg | ~10% above avg | Both are above average, but SD's milder temps (less AC/heat) can sometimes help. |

| Groceries | ~12% above avg | ~5% below avg | St. Louis has a lower cost for everyday essentials. |

| Median Income | $105,780 | $56,245 | The gap is massive. San Diego's median income is nearly double St. Louis's. |

Let's play a game. You're offered a $100,000 job. Where do you feel richer?

In San Diego ($100k): After California's high state income tax (ranging from 1% to 12.3% for that bracket), you're taking home roughly $70,000-$72,000 post-tax. Your rent for a decent 1BR is $2,248, eating up about 38% of your take-home pay. That leaves you with a comfortable but not extravagant lifestyle. You can afford a car payment, go out for dinner, and save for retirement, but buying a median home ($930,000) is a monumental, likely impossible, challenge on this salary alone. The "purchasing power" is heavily skewed towards lifestyle (experiences, dining) but not assets.

In St. Louis ($100k): Missouri has a flat state income tax of 4.95%. Your take-home would be roughly $77,000. Your rent for a nice 1BR is $972, consuming a mere 15% of your income. The math is staggering. You have over $5,000 per month left after rent for savings, investments, travel, and fun. You could save the down payment for a median home ($235,000) in a shockingly short time. The "purchasing power" here is off the charts—you feel wealthy.

Verdict on Dollar Power:

While San Diego's high median income suggests a wealthier population, the cost of living eats it alive. St. Louis, despite lower salaries, offers unparalleled financial freedom and asset-building potential. If you earn an above-average salary in St. Louis, you live like royalty. In San Diego, you live like a comfortable professional.

CALLOUT BOX: The Purchasing Power Winner: St. Louis

For the vast majority of earners, especially those not in high-paying tech or biotech fields, St. Louis wins decisively. The ability to own a home, save aggressively, and have disposable income on a median salary ($56k) is a game-changer that San Diego simply cannot match.

Verdict on Housing: It's a tale of two markets. St. Louis is the clear winner for aspiring homeowners. San Diego's housing is a luxury good, accessible only to the top earners or those who bought in decades ago. If owning a home is a core life goal, St. Louis makes it achievable. San Diego makes it a distant dream for most.

This is where your personal tolerance for risk and discomfort comes into play.

Winner: St. Louis. Less time in the car means more time living.

Winner: San Diego. By a landslide. The climate is a tangible asset that affects daily mood, health, and activity levels.

Let's be blunt. The data provided is a snapshot, and crime rates vary wildly by neighborhood in both cities. However, the numbers tell a stark story.

Crucial Context: You must research specific neighborhoods. A safe suburb of St. Louis (like Chesterfield or Ballwin) has crime rates far below the city's average. Similarly, certain parts of San Diego (like parts of East County) have higher crime.

Verdict on Safety: This is a complex category. San Diego, as a whole, has a significantly lower violent crime rate. For a newcomer with no local knowledge, the statistical risk is lower in San Diego. However, in St. Louis, your safety is heavily dependent on where you choose to live. If you do your homework and pick a safe neighborhood, you can live securely. But the city's overall reputation and stats are a major concern.

After breaking down the data, the lifestyle, and the costs, here’s the final call.

Why? The math is undeniable. A family can afford a safe, spacious single-family home in a good school district on a combined income that would be struggling in San Diego. The cost of living allows for more financial breathing room—saving for college, vacations, and retirement. While the weather and overall "glamour" factor are lower, the practical benefits of homeownership and financial stability are paramount for most families.

Why? If you're in a high-earning field (tech, biotech, finance) and can command a salary well above $100k, San Diego offers an unparalleled lifestyle. The social scene, outdoor activities, and vibrant culture are perfect for networking and building a life. The high cost is the price of admission for living in one of the country's most desirable locations. For the ambitious 20-something, it's an experience worth the premium.

Why? Retirees on a fixed income need their savings to last. St. Louis offers a dramatically lower cost of living, especially in housing and taxes. You can sell a home in a coastal market and buy a comparable one in St. Louis for a fraction of the price, freeing up capital. The city has excellent healthcare (thanks to Washington University and BJC) and a slower pace of life. While the weather is a downside, the financial security it provides is a bigger win for most retirees.

PROS:

CONS:

PROS:

CONS:

This isn't about which city is "better"—it's about which city is better for you.

Choose San Diego if you prioritize lifestyle, climate, and career opportunities in high-paying fields, and you have the financial means (or the willingness to sacrifice housing space) to pay the premium.

Choose St. Louis if you prioritize financial freedom, homeownership, and a lower cost of living, and you're willing to trade perfect weather for a life where your salary feels like it has superpowers. If you choose St. Louis, your homework is to research neighborhoods meticulously to ensure safety and quality of life.

The data makes one thing crystal clear: San Diego sells a dream, but St. Louis offers a reality that's financially empowering for most. The question is, which dream are you chasing?