The Big Items: Where the Money Actually Goes

The bulk of your disposable income will be eaten by the "Big Three": Housing, Transportation, and Taxes. In Oshkosh, the dynamics of these costs are deceptive. While housing looks cheap on paper, the tax structure works differently than you might be used to, and the local geography forces a dependence on personal vehicles, adding a hidden tax on every mile driven.

Housing: The Rent vs. Buy Trap

The rental market for a 1BR sits at $779 and a 2BR at $1010. On the surface, this is a steal compared to Madison or Milwaukee. However, the "comfortable" earner looking to buy faces a different beast. The median home price of $225,000 sounds affordable, but the inventory is thin. You aren't just competing with other families; you are competing with investors turning properties into rentals, which keeps supply low and prices sticky. If you are considering buying, be prepared for the "starter home" to cost significantly more than the median once you factor in the bidding wars. The rent trap is real here; it is cheaper to rent than to service a mortgage with today's interest rates, but renting means you are throwing away $12,120 a year on a 2BR with zero equity. It’s a lose-lose scenario for the wealth builder.

Taxes: The Wisconsin Bite

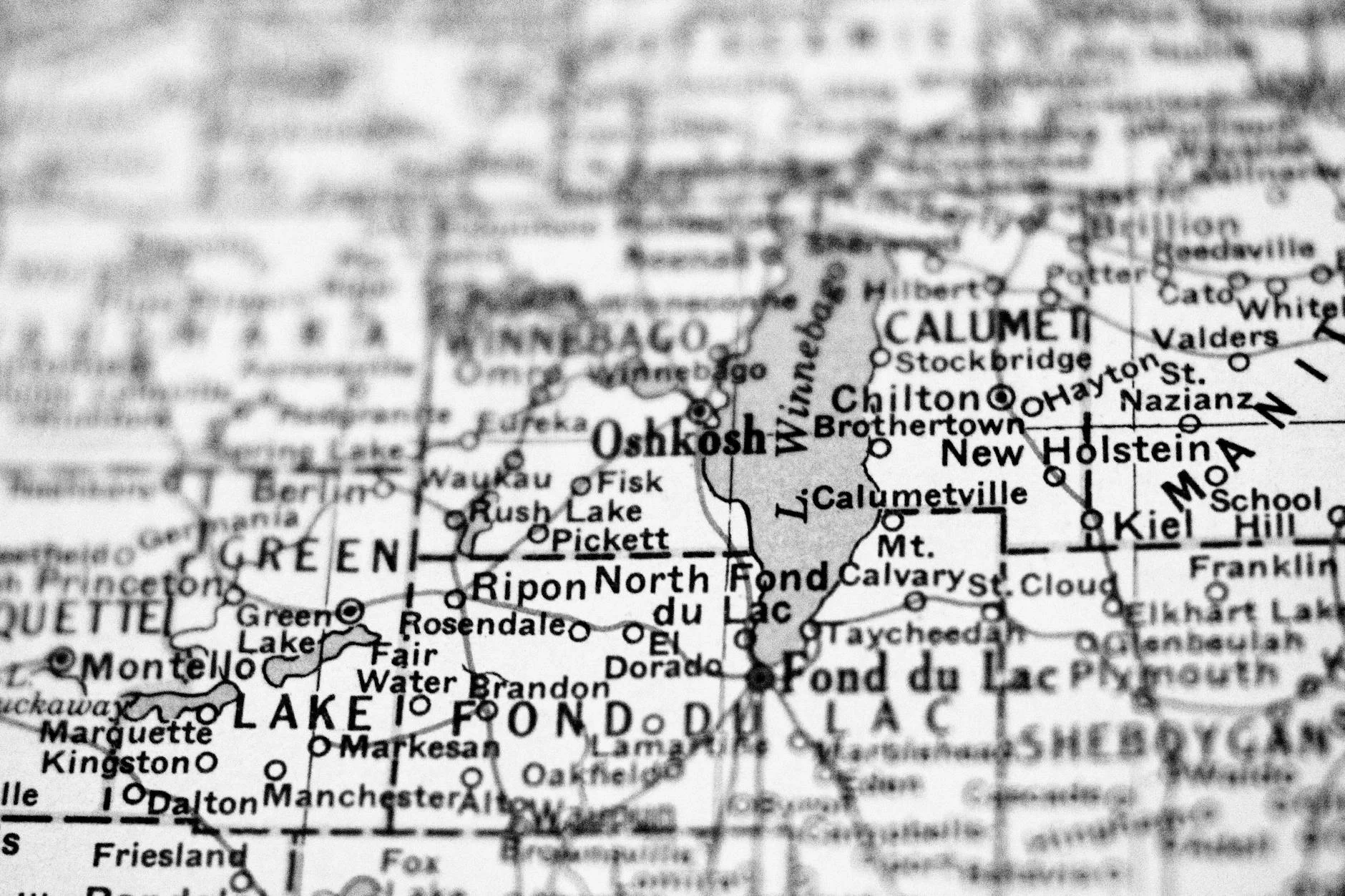

Do not let the low home prices fool you; Wisconsin is a high-tax state, and it will nickel and dime you at every turn. The state income tax is progressive, but for a single earner making $34,185, you are looking at a marginal rate that hovers around 4.4% to 5.3% depending on deductions. The real killer, however, is property tax. In Winnebago County, you can expect property taxes to be roughly 1.8% of the assessed value annually. On a $225,000 home, that is $4,050 a year in taxes alone—that is $337.50 a month that builds zero equity and never goes away. You pay this even after the mortgage is paid off. Combine this with a sales tax of 5.5% (local municipality adds on top), and you are bleeding money every time you buy a stick of gum or a tank of gas.

Groceries & Gas: The Local Variance

Groceries in Oshkosh run about 5% to 8% above the national baseline. This isn't because of luxury goods; it's logistics. We are inland, and getting fresh produce here costs more than in coastal hubs. Expect to pay $4.50 for a gallon of milk and roughly $3.99 for a dozen eggs at standard retailers. Gas is the bigger shocker. While we are near refineries, the local variance is high. You will likely pay within 2-3 cents of the national average, currently hovering around $3.20 - $3.40 a gallon. However, because Oshkosh is geographically spread out with poor public transit, you will drive significantly more miles than a city dweller. Your car dependency is a forced expense, not a choice.