The Big Items: Where the Budget Bleeds

Housing: The Rent vs. Buy Trap

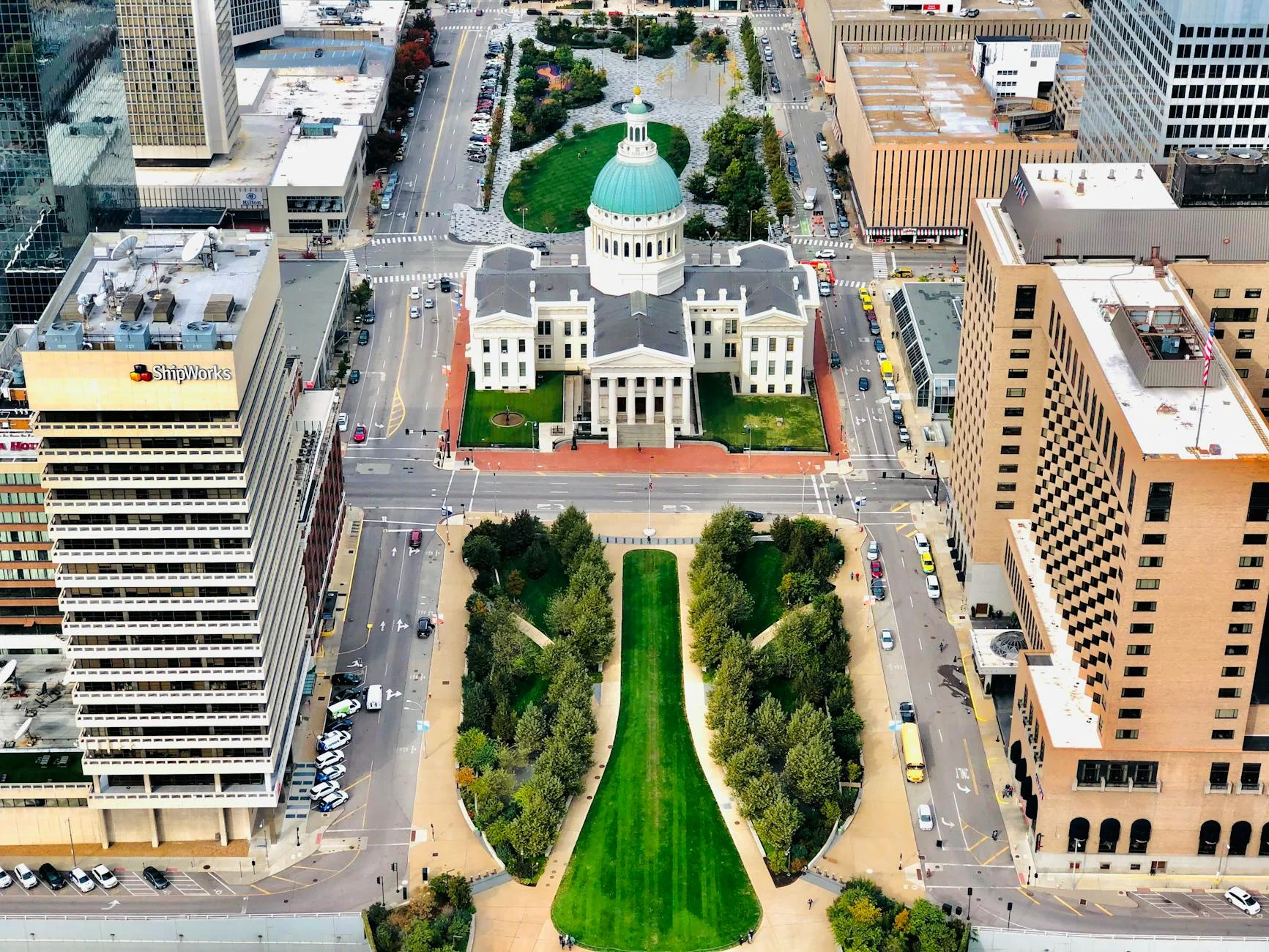

St. Louis presents a deceptive housing market. On paper, it looks like a bargain compared to the coasts. A one-bedroom apartment averages $972, while a two-bedroom commands $1,209. For a single earner making $30,934, spending $972 on rent consumes over 30% of gross income immediately, pushing you into the "cost-burdened" category defined by housing experts. However, buying isn't necessarily the escape hatch it seems. The local market is bifurcated. You have "move-in ready" homes in desirable areas (Ladue, Clayton, Kirkwood) that carry astronomical price tags, forcing you into a mortgage that dwarfs rent. Conversely, the "affordable" stock often comes with a hidden tax bill or requires significant capital investment for basic repairs. The "heat" in the market isn't necessarily in the sale price, but in the competition for quality rentals. Landlords know they can charge premiums for updated units because the buy-in cost for ownership is so high for the average earner. If you are looking at a $1,209 two-bedroom, you are likely compromising on location or condition, as the gap between "cheap" and "livable" is widening.

Taxes: The State and Local Bite

Missouri’s "low tax" reputation requires a massive asterisk. The state income tax is progressive, starting at 1.5% and capping at 4.8% (as of the 2026 projections). For a single earner hovering around $30,934, you’re looking at roughly 4.5% effective rate, which isn't terrible, but it compounds with the real killer: local earnings taxes. If you work in the City of St. Louis or certain other municipalities (like Jennings or University City), you are hit with a 1% earnings tax. That is an immediate 1% haircut off the top of your paycheck that you cannot deduct. Then comes the property tax bite for homeowners. While the effective rate hovers around 1.1%, the assessed valuation can be a sticker shock. On a $300,000 home, you are looking at roughly $3,300 in property taxes annually. This is often escrowed, hiding the pain, but it is a non-negotiable expense that rises with assessments, eating into any potential equity gain.

Groceries & Gas: The Local Variance

Your grocery bill in St. Louis is highly dependent on your zip code. The baseline is roughly 2% lower than the national average, but don't get comfortable. If you rely on Schnucks in a premium suburb, you are paying a convenience tax. Go to the "Dierbergs" in wealthier enclaves, and the basket price skyrockets. You have to be a savvy shopper to beat the national baseline. Gas is the other wildcard. As of 2026, St. Louis gas prices track closely with the national average, currently hovering around $3.10 - $3.30 per gallon. However, the "local variance" comes from the commute. St. Louis is a sprawling metropolis with poor public transit infrastructure compared to Chicago or NYC. If you live in the city but work in St. Charles County, you are burning significant fuel. The 12.91 cents/kWh electric rate is actually a bright spot—significantly lower than the US average—which helps offset the gas costs, but only if you aren't paying a premium for "deregulated" supply.