The Big Items: Where Your Paycheck Goes to Die

Housing: The Equity Gamble vs. The Rental Trap

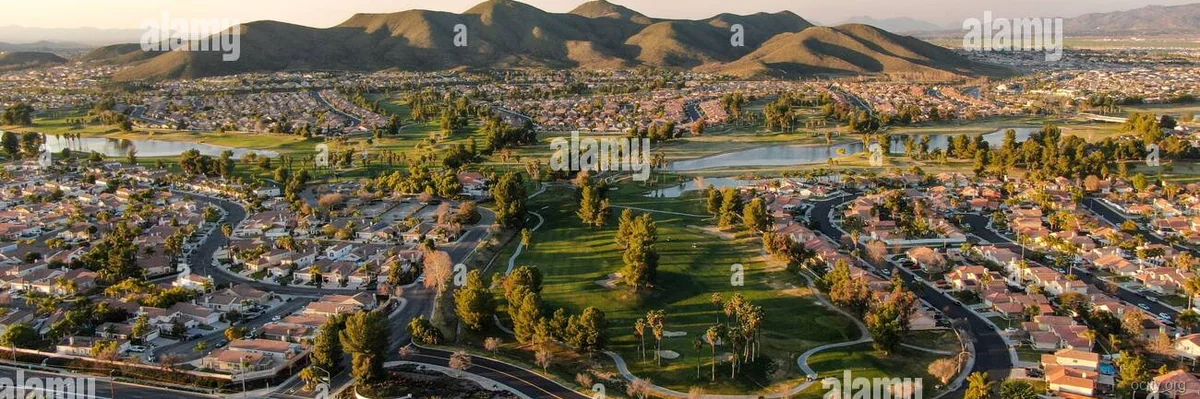

The housing market in Temecula is a paradox of "affordability" relative to coastal California, but a nightmare in isolation. If you are looking to rent, a two-bedroom unit will set you back roughly $2,201 per month. This isn't just paying for a roof; it's the price of flexibility. The trap here is the "lock-in effect." Homeowners who secured sub-4% mortgages are refusing to sell, choking inventory and propping up prices. This forces potential buyers into a brutal competition for scarce inventory, often resulting in bidding wars that push the median home price well beyond reasonable debt-to-income ratios. Buying is a leveraged bet on appreciation, but with interest rates remaining volatile, the monthly mortgage payment on a median-priced home can easily eclipse $4,000 to $5,000 once you factor in the mandatory insurance premiums. The "buy vs. rent" calculator favors buying only if you stay put for a decade; otherwise, the closing costs and interest front-loading eat you alive.

Taxes: The California Cannibalism

California’s tax appetite is the single biggest drag on your purchasing power. While the state income tax is progressive, it is aggressively punitive to the middle class. A single earner making the median $66,987 falls into the 9.3% bracket (after the standard deduction), but that ignores the effective rate which includes the Mental Health Services Act. The real gut punch, however, is property tax. While California’s base rate is capped at 1% under Prop 13, the "assessed value" is the killer. On a $750,000 home (a conservative estimate for a starter family home in the area), you are looking at $7,500 annually just for the base tax. However, local bonds and parcel taxes can add another $1,000 to $2,000 to that bill. When combined with state income tax, you are looking at an effective tax rate that likely hovers around 12-15% of your gross income before you even pay for shelter.

Groceries & Gas: The Invisible Inflation

Don't rely on national averages for your food budget; the supply chain in Southern California is distinct. Groceries here run approximately 8% higher than the national baseline. This isn't just corporate price-gouging; it’s the cost of trucking produce through the congested Inland Empire corridors. You will feel the sticker shock at the checkout line for staples like beef and dairy. Gasoline is the other variable that nickel-and-dimes you to death. California gas prices are consistently $1.00 to $1.50 higher per gallon than the national average due to state excise taxes and specific fuel blend requirements. If you have a commute—say, 30 miles round trip—you are easily spending $250+ per month on fuel alone. This local variance means your "discretionary" income is actually being siphoned off by the necessities of getting to work and feeding the family.