The Big Items

Housing: The Rent Trap vs. The Buying Illusion

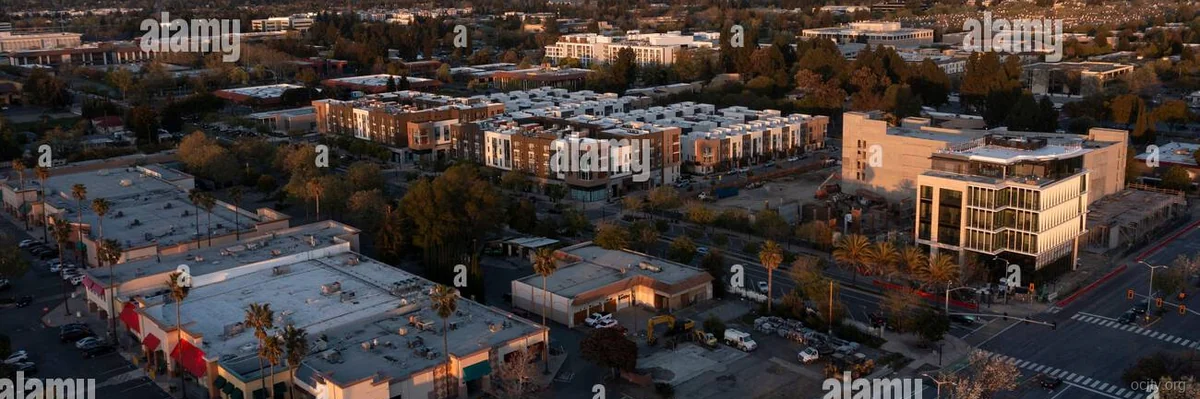

Housing is the primary engine of financial destruction in Fremont. Currently, the median rent for a one-bedroom sits at $2,131, while a two-bedroom demands $2,590. If you are looking to rent, you are essentially trading equity for flexibility, but the market heat here means vacancy rates are razor-thin. Landlords know they can charge a premium because the alternative is a commute from Tracy or Sacramento. Buying, however, isn't the golden ticket it appears to be in other markets. With a median home price that often fluctuates due to inventory shortages (and a median listing price often exceeding $1.2M in desirable pockets), the mortgage payment is astronomical. But the real trap isn't the sticker price; it's the property tax. In California, you pay roughly 1.1% of the purchase price annually, but thanks to Proposition 13, that tax basis is locked in for the seller, not you. When you buy a $1,200,000 home, you are paying taxes on the current value, likely pushing your annual property tax bill over $13,000. That is $1,083 a month just for the privilege of owning the dirt, before a single cent of mortgage principal is paid.

Taxes: The State and Local Bite

California is not friendly to your wallet. While the median income of $170,934 looks rosy, the progressive tax structure takes a massive chunk. A single earner making $94,013 falls into the 9.3% state income tax bracket (after the standard deduction), which is significantly higher than states like Texas or Florida. However, the hidden tax is the sales tax. Fremont’s combined sales tax rate is 9.875%. Every time you buy a non-food item, nearly a dime on the dollar evaporates. If you buy a $30,000 car, you are paying an immediate $2,962 in taxes. This creates a "wealth erosion" effect where your purchasing power is constantly diminished. Furthermore, if you have any investment income, the state taxes that as well, meaning you get nickel-and-dimed on money you've already earned.

Groceries & Gas: The Slow Bleed

Don't expect to save money on consumables. Fremont grocery prices track about 15-20% higher than the national baseline due to distribution costs and local demand. A standard run for two people can easily hit $150 if you aren't careful. Gas is even worse. The average price per gallon hovers around $4.50 - $5.00, compared to the national average which is often a dollar less. For a commuter driving 30 miles round trip in a sedan getting 30 MPG, that is roughly $150 a week in fuel alone, or $600 a month. That is $7,200 a year just to get to work, a cost that scales aggressively with every mile you drive.