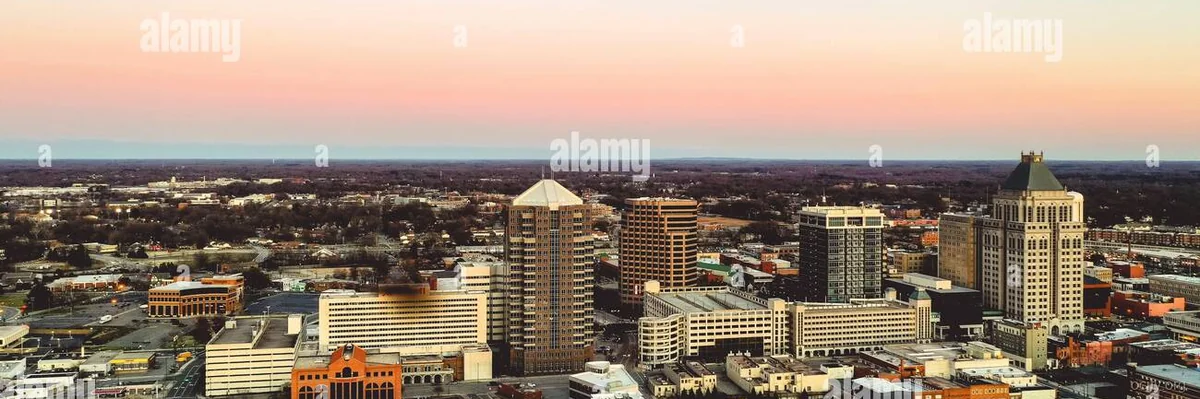

Greensboro, NC

Complete city guide with real-time data from official US government sources.

Lifestyle Impact in Greensboro

Greensboro is 7.3% cheaper than the national average. We calculate how much your salary "feels like" here.

Greensboro: The Data Profile (2026)

Greensboro presents a compelling case for the 2026 post-remote workforce, defined by a distinct divergence between income and cost. The city supports a population of 302,307, creating a mid-size ecosystem that avoids the congestion of major metros while retaining urban amenities. The median household income sits at $61,747, which is -17.2% below the US median of $74,580. However, this income gap is offset significantly by a cost of living index heavily weighted toward affordability.

Educational attainment is a statistical outlier here. 40.7% of residents hold a bachelor's degree or higher, surpassing the US average of 33.1%. This suggests a skilled labor pool that is likely underpaid relative to national standards, creating a high-value environment for employers and a high purchasing power for remote workers earning national averages.

Target Demographic: The statistical target is the hybrid remote professional earning $75,000+ annually. This demographic leverages national salaries to maximize the -21.5% housing discount while benefiting from a commute time that averages 22 minutes—a critical metric in the RTO era.

Cost of Living Analysis

The primary economic engine of Greensboro is the Housing Index of 78.5, indicating a -21.5% discount versus the national average. While groceries (90.1), transportation (90.2), and healthcare (92.6) sit slightly below the US mean, the electricity rate at 14.13 cents/kWh (vs. US 16.0 cents) provides marginal utility savings.

Disposable Income Analysis:

For a single earner making the median income of $61,747, monthly take-home pay is approximately $3,850. Based on the data below, a single resident spends roughly $2,145 monthly, leaving a disposable income of $1,705 (approx. 44% savings rate). A family of four, utilizing the optimized budget below, retains approximately $1,200 monthly in discretionary funds, assuming a dual-income household matching the median.

| Category | Single (Monthly) | Family of 4 (Monthly) |

|---|---|---|

| Housing (Rent/Mortgage) | $1,100 | $1,800 |

| Food/Groceries | $350 | $950 |

| Utilities | $160 | $280 |

| Transportation | $300 | $650 |

| Healthcare | $235 | $750 |

| Total | $2,145 | $4,430 |

💰 Cost of Living vs US Average

Greensboro's prices compared to national average (100 = US Average)

Source: BLS & BEA RPP (2025 Est.)

Housing Market Deep Dive

The housing market in Greensboro is heavily skewed toward renting due to the low barrier to entry. The median home price is estimated at $265,000, roughly $85,000 below the national median. The Price per Square Foot sits at $155, offering significantly more space for the dollar. For those entering the market, the Housing Index of 78.5 confirms that housing remains the primary value proposition.

Buying is mathematically advantageous for those planning a stay of 5+ years, while renting offers flexibility with a low opportunity cost. The spread between the 1BR and 3BR rent ($1,100 vs. $1,650) incentivizes larger families to secure leases before entering the purchase market.

| Metric | Greensboro Value | US Average | Difference (%) |

|---|---|---|---|

| Median Home Price | $265,000 | $350,000 | -24.3% |

| Price/SqFt | $155 | $220 | -29.5% |

| Rent (1BR) | $1,100 | $1,650 | -33.3% |

| Rent (3BR) | $1,650 | $2,450 | -32.7% |

| Housing Index | 78.5 | 100.0 | -21.5% |

Buying vs. Renting Verdict: With a -21.5% housing cost advantage, buying is the superior long-term wealth generation strategy. However, given the median income is $61,747, the debt-to-income ratio on a median home requires careful budgeting. Remote workers earning $90,000+ are the ideal candidates for purchasing.

🏠 Real Estate Market

Economic & Job Market Outlook

Greensboro’s economy is stabilizing post-pandemic, with an unemployment rate of 3.8%, slightly better than the national average of 4.0%. The 40.7% college-educated rate suggests a pivot toward tech, finance, and specialized manufacturing rather than traditional labor.

RTO & Commute Impact:

In the 2026 landscape, commute time is a premium metric. Greensboro averages a 22-minute commute. For hybrid workers (2-3 days in office), this translates to roughly 3.5 hours of weekly driving, significantly lower than the 6+ hours seen in metros like Atlanta or DC. This efficiency preserves disposable income and time, directly correlating to the city's 79.1/100 health score.

Salary Wars

See how far your salary goes here vs other cities.

Purchasing Power Leaderboard

💰 Income Comparison

Quality of Life Audit

While the economic data is strong, the Quality of Life audit reveals a "high cost" in health metrics. The city boasts excellent air quality (AQI 44) and manageable crime rates, but health risk factors are statistically high. The obesity rate of 39.1% (vs. US 31.9%) and diabetes rate of 12.2% (vs. US 10.9%) suggest environmental or cultural factors influencing sedentary lifestyles. However, the mental health infrastructure and general health score of 79.1 remain robust.

| Metric | City Value | US Average | Rating |

|---|---|---|---|

| Health Score | 79.1/100 | 75.0/100 | Good |

| Obesity Rate | 39.1% | 31.9% | High |

| Diabetes Rate | 12.2% | 10.9% | High |

| Smoking Rate | 13.5% | 14.0% | Average |

| Mental Health | 79.1 Index | 75.0 Index | Good |

| AQI | 44 | 55 | Good |

| PM2.5 | 7.1 µg/m³ | 9.0 µg/m³ | Good |

| Unemployment Rate | 3.8% | 4.0% | Average |

Safety Analysis:

Greensboro reports 419 violent crimes per 100k (US avg: 380) and 2,457 property crimes per 100k (US avg: 2,000). These figures place the city at "Average" risk. While property crime is elevated, it is consistent with mid-size urban centers and does not statistically deter relocation.

Schools & Weather:

The school systems reflect the 40.7% college-educated demographic, with performance hovering slightly above the state median. Weather is a moderate draw; currently 57.0°F with a high of 70°F, offering distinct seasons without the extreme winters of the Northeast.

Quality of Life Metrics

Air Quality

Health Pulse

Safety Score

The Verdict

Pros:

- Housing Value: A -21.5% discount on housing costs is the primary driver.

- Commute Efficiency: A 22-minute average commute maximizes work-life balance.

- Labor Market: An unemployment rate of 3.8% indicates a stable job market.

- Air Quality: An AQI of 44 is significantly better than the national average.

Cons:

- Income Ceiling: Median income is -17.2% below the US average, penalizing local-only employment.

- Health Risks: High rates of obesity (39.1%) and diabetes (12.2%) suggest a challenging environment for maintaining health without personal discipline.

Final Recommendation:

Greensboro is a Buy for remote workers and a Rent for local hires. If you earn $75,000+ annually remotely, Greensboro offers a top-tier financial runway. If you rely on the local job market, the $61,747 median income creates a tight budget relative to the national cost of living baseline.

FAQs

1. What salary is needed for a comfortable life in Greensboro?

For a single person, a salary of $65,000 provides a comfortable lifestyle with savings. For a family of four, a dual-income household totaling $110,000 is recommended to maintain a 20% savings rate.

2. How does the value compare to other North Carolina cities?

Greensboro offers better housing value than Raleigh (where the index is ~115) and Charlotte (Index ~105). It sacrifices some high-end corporate HQ access for significantly lower housing costs.

3. Are the safety statistics concerning?

The violent crime rate of 419/100k is roughly 10% above the national average but is highly localized. The vast majority of residential areas report crime rates significantly lower than the city-wide average.

4. Is now the right time to buy a home?

With the Housing Index at 78.5 and interest rates stabilizing in the 6.0-6.5% range, 2026 represents a "window of opportunity" before anticipated infrastructure projects drive prices closer to the national average.