The Big Items: Where Your Paycheck Disappears

Housing: The Equity Trap vs. The Rental Squeeze

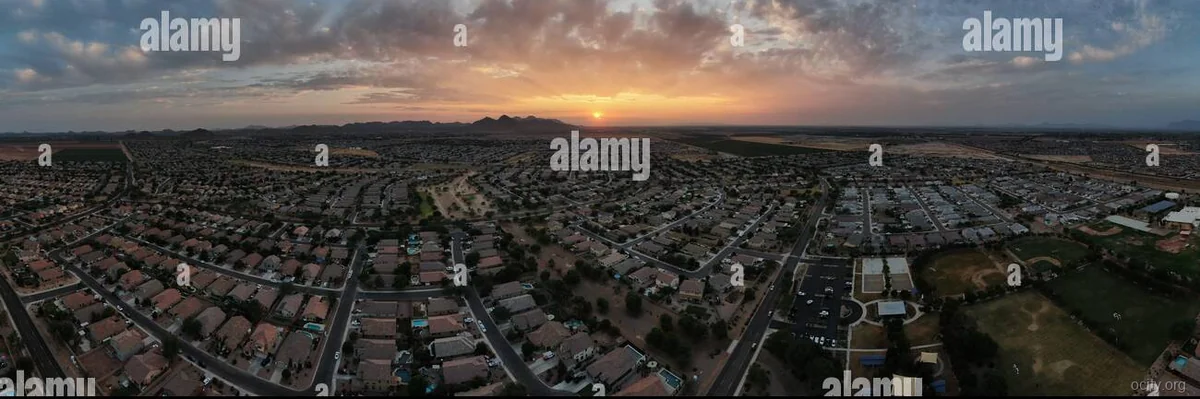

The housing market in Queen Creek is a study in volatility disguised as stability. If you are looking to rent, the data point you have is a 2-bedroom average of $1,380. In a vacuum, this looks reasonable. However, the "vacuum" is the problem. Inventory is perpetually tight because this is a high-equity flight destination. Landlords know they can push rents higher because the alternative—buying—is even more punishing. The median home price data is "None" in your set, which is the most honest answer of all: the median is irrelevant because the entry-level floor has moved out of reach for the average single earner. Buying a home here is not a mortgage payment; it is a $400,000+ commitment that immediately puts you in the red for the first five years. You are paying for the idea of the lifestyle before you can afford the reality. The market heat comes from the influx of capital from California and Washington; you aren't competing with your neighbors, you are competing with equity transfers from out of state.

Taxes: The "Low Tax" Illusion

Arizona loves to brag about its low income tax, currently sitting at a flat 2.5%. That is technically true, but it’s a distraction. The real financial bleed happens at the county and municipal level. Maricopa County property taxes are calculated on a limited value system, but don't let that fool you. With a median home price hovering around $525,000 (market value), you are looking at an assessed value that creeps up annually. You can expect an effective property tax rate that, when combined with local bonds and overrides for schools and fire departments, hovers around 0.65% to 0.75%. This translates to roughly $3,500 to $4,000 annually in property taxes alone—before you pay the Mello-Roos or Community Facilities District (CFD) fees that plague newer developments in Queen Creek. These CFDs can add another $500 to $1,200 per year, a hidden tax for infrastructure that doesn't show up in the "low tax" sales pitch.

Groceries & Gas: The Desert Surcharge

You will feel the sting at the grocery store. Queen Creek is a suburban island; getting fresh produce here costs more than in the dense urban cores of Phoenix. While the national baseline for food costs is a benchmark, you should budget for a 10% to 15% premium on staples, specifically dairy and produce, due to logistics and the "affluent suburb" markup. The real killer, however, is transportation. The "local variance" here is massive because of distance. Everything is a 15-minute drive. The electric rate of 14.91 cents/kWh is actually a relief compared to the national average, but that savings is immediately obliterated by gasoline costs and vehicle wear and tear. You will drive significantly more miles here than a national average suggests, and the stop-and-go traffic on the Santan Freeway (Loop 202) destroys fuel efficiency.