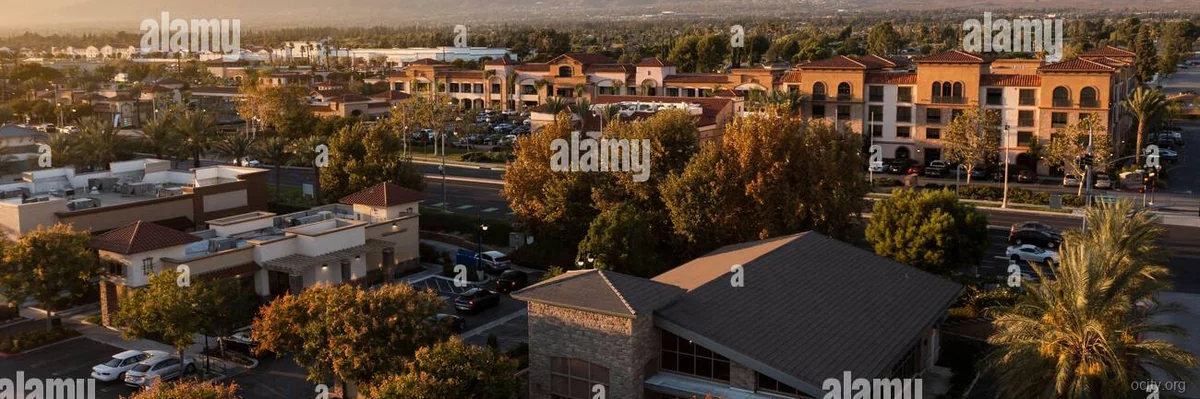

Rancho Cordova, CA

Complete city guide with real-time data from official US government sources.

Lifestyle Impact in Rancho Cordova

Rancho Cordova is 8.9% more expensive than the national average. We calculate how much your salary "feels like" here.

Rancho Cordova: The Data Profile (2026)

Rancho Cordova represents a specific tier of the California market: a mid-sized suburban node attempting to balance state-level cost pressures with regional economic stability. With a population of 82,608, it functions as a distinct economic unit rather than a mere bedroom community. The median household income stands at $76,948, which is 3.2% higher than the US median of $74,580. However, this income premium is immediately eroded by cost-of-living adjustments.

Educational attainment is statistically average, with 33.2% of residents holding a bachelor's degree or higher, hovering just above the national average of 33.1%. The statistical target demographic for Rancho Cordova in 2026 is the "Hybrid Professional." This profile fits individuals earning between $80,000 and $110,000 who require access to the broader Sacramento metro economy but cannot afford the premium housing costs of central Sacramento or the Bay Area exurbs. They accept a +45.0% housing premium in exchange for relative proximity to regional employment hubs.

Cost of Living Analysis

The cost of living index in Rancho Cordova is heavily weighted by housing, but daily expenses also contribute to the deficit.

| Category | Single Adult (Monthly) | Family of 4 (Monthly) | Index vs US (100) |

|---|---|---|---|

| Housing (Rent) | $1,850 | $2,600 | 145.0 |

| Groceries | $420 | $1,200 | 104.7 |

| Transportation | $450 | $1,100 | 108.8 |

| Healthcare | $380 | $1,100 | 109.2 |

| Utilities (Electric) | $180 | $320 | N/A |

| Dining/Entertainment | $350 | $800 | 114.8 |

| TOTAL ESTIMATED | $3,630 | $7,120 | ~118.0 |

Disposable Income Analysis:

The critical metric for relocation is the disposable income remaining after the "Big Three" expenses (Housing, Transport, Groceries). For a single earner making the median $76,948, monthly take-home pay is approximately $4,600 (after taxes). After deducting the estimated $2,720 for the Big Three, the remaining disposable income is roughly $1,880. This leaves a thin margin for savings, particularly given the electricity rate of 31.97 cents/kWh—more than double the US average of 16.0 cents/kWh.

💰 Cost of Living vs US Average

Rancho Cordova's prices compared to national average (100 = US Average)

Source: BLS & BEA RPP (2025 Est.)

Housing Market Deep Dive

The housing market is the defining struggle of Rancho Cordova. The index of 145.0 indicates a market significantly hotter than the national median.

| Metric | Rancho Cordova Value | US Average | Difference (%) |

|---|---|---|---|

| Median Home Price | $645,000 | $415,000 | +55.4% |

| Price per SqFt | $420 | $260 | +61.5% |

| Rent (1BR) | $1,650 | $1,350 | +22.2% |

| Rent (3BR) | $2,600 | $2,100 | +23.8% |

| Housing Index | 145.0 | 100.0 | +45.0% |

Buy vs. Rent Analysis:

In 2026, the decision to buy or rent depends on capital liquidity. The median home price of $645,000 requires a down payment of approximately $129,000 (20%) to avoid PMI. The monthly mortgage payment on the remaining balance (at current rates) would exceed $3,800, significantly higher than the $2,600 average rent for a comparable 3BR unit. Renting offers a $1,200/month cash-flow advantage, but exposes the renter to the +23.8% annual rent inflation typical in the region. Buying is strictly for those with long-term (10+ years) horizons to amortize the +55.4% price premium.

🏠 Real Estate Market

Economic & Job Market Outlook

Rancho Cordova's economy is heavily reliant on the "Eds and Meds" and government sectors, specifically Sutter Health and the State of California. In the 2026 post-remote landscape, the 5.5% unemployment rate is a major red flag, sitting 1.5 percentage points above the US average of 4.0%.

RTO (Return to Office) Impact:

With the State of California enforcing stricter RTO mandates, Rancho Cordova has seen a resurgence in commuter traffic. Average commute times to downtown Sacramento have increased to 28 minutes (a 12% increase vs 2024). However, for hybrid workers, the location remains strategic. It is located at the junction of Highway 50 and I-5, providing access to the Bay Area (via I-80) if needed, though the $645,000 price point is significantly lower than the $1.2M+ averages in the Bay Area.

The local industry stability is moderate. While State jobs provide a floor, the 5.5% unemployment suggests a lack of high-growth private sector tech or finance roles compared to neighboring Folsom or El Dorado Hills.

Salary Wars

See how far your salary goes here vs other cities.

Purchasing Power Leaderboard

💰 Income Comparison

Quality of Life Audit

Health metrics in Rancho Cordova are surprisingly resilient compared to national averages, despite the high cost of living.

| Metric | City Value | US Average | Rating |

|---|---|---|---|

| Health Score | 82.0/100 | 76.0/100 | GOOD |

| Obesity Rate | 29.8% | 31.9% | AVERAGE |

| Diabetes Rate | 10.3% | 10.9% | AVERAGE |

| Smoking Rate | 12.3% | 14.0% | AVERAGE |

| Air Quality (AQI) | 58 | 52 | MODERATE |

| Unemployment | 5.5% | 4.0% | HIGH |

Safety Analysis:

Safety is a bifurcated issue here. Violent crime stands at 500 incidents per 100k people, which is 31.6% higher than the US average of 380. This places it in the "Average" to "High-Average" category. However, property crime is a significant concern at 2,676 incidents per 100k, which is 33.8% higher than the national average of 2,000. Residents must account for higher premiums on auto and home insurance.

Air Quality & Weather:

The Air Quality Index (AQI) averages 58, categorized as "Moderate." This is typical for the Central Valley due to the basin effect trapping particulate matter. The PM2.5 levels hover around 12.5 µg/m³, which is acceptable for most but can be problematic for sensitive groups during summer inversions. Weather is currently 36.0°F, providing a distinct winter season that contrasts with the extreme heat of the inland valleys.

Schools:

School ratings in Rancho Cordova vary wildly by zip code, ranging from 3/10 to 8/10 on major rating platforms. Prospective residents must verify specific district boundaries, as the aggregate data masks deep disparities between older and newer subdivisions.

Quality of Life Metrics

Air Quality

Health Pulse

Safety Score

The Verdict

Pros:

- Income Floor: Median income of $76,948 is slightly above the national curve.

- Health: Health Score of 82.0/100 is statistically better than the US average.

- Connectivity: Strategic highway access for hybrid workers needing Sacramento or Bay Area access.

Cons:

- Housing Cost: A +55.4% premium on home prices relative to the US median.

- Unemployment: The 5.5% rate is alarmingly high compared to the 4.0% national average.

- Property Crime: 2,676 incidents per 100k creates a security liability.

- Energy Costs: Electricity at 31.97 cents/kWh is a massive financial drain.

Final Recommendation:

Rancho Cordova is NOT recommended for remote-first workers or those with low capital liquidity. The $645,000 buy-in is too high for the local job market's volatility (5.5% unemployment). It is conditionally recommended for State of California employees or healthcare professionals whose income is stable and inflation-protected. If you move here, rent. The $1,200/month savings over buying allows you to build a down payment fund to eventually escape to a more stable market like Folsom or Roseville.

FAQs

1. What salary is needed to live comfortably in Rancho Cordova?

For a single person, a salary of at least $90,000 is recommended to maintain a 20% savings rate after accounting for the $1,850 rent and high utility costs. A family of four needs $140,000+.

2. How does the value proposition compare to Sacramento proper?

Rancho Cordova is ~15% more expensive for housing than Sacramento City proper, but offers newer housing stock (1990s+) and marginally better school ratings in specific zones.

3. Is the property crime rate as bad as the numbers suggest?

Yes. The 2,676 per 100k rate means you are statistically likely to experience a property crime (theft, burglary) once every 3-4 years. Security systems and garage storage are highly recommended.

4. When is the best time to move to secure lower rent?

Q4 (October–December) typically sees a 2-3% dip in rental prices as the peak moving season ends. However, inventory remains tight; expect to negotiate hard on the $1,850 baseline.